|

|

Crew members ready for boarding a train traveling along the China-built Ethiopia-Djibouti Railway in Addis Ababa, capital of Ethiopia. [Photo/Xinhua] |

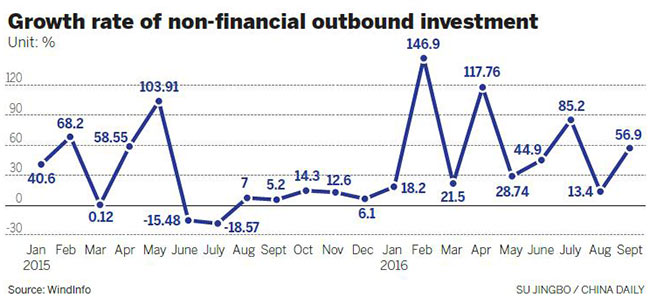

China's outbound direct investment jumped 53.7 percent year-on-year to 882.78 billion yuan ($134.22 billion) in the first three quarters of this year, the Ministry of Commerce said on Tuesday.

Chinese companies completed 521 overseas merger and acquisition projects, including 119 in the United States, during the first nine months, with the transaction value reaching $67.44 billion, surpassing the total amount of last year.

The mergers and acquisitions involved 18 industries in 67 countries and regions.

"The investment categories of Chinese companies have been further expanded in overseas companies. High-end manufacturing, information transmission and software technology services were hot areas for China's ODI over the past nine months," said Shen Danyang, the ministry's spokesman.

The US, the Cayman Islands and Hong Kong ranked the top three hot destinations for Chinese mainland investment, with a total amount of $16.24 billion, $15.71 billion and $9.32 billion respectively.

Shen said the Belt and Road Initiative had also boosted business cooperation between Chinese and overseas firms.

A total of 4,191 engineering contracts were signed by Chinese companies in 61 countries along the Belt and Road routes between January and September, with a combined contract value of $74.56 billion.

Chinese companies invested $17.9 billion in 56 economic and trade cooperation zones in 20 countries along the Belt and Road during the same period, creating 163,000 jobs for local people.

"China's investment in railway projects in African countries including Nigeria, Ethiopia and Djibouti has also boosted exports of the country's power generating equipment, construction machinery, building materials, telecommunications, railway vehicles and signal systems," said Shen.

CIMC ENRIC Holding Ltd-the energy, chemical and liquid food equipment manufacturing unit of China International Marine Containers (Group) Ltd-made an outright purchase in June of United Kingdom-based Briggs Group Ltd, a food equipment provider, for 23 million pounds ($28.6 million).

With its technologies, CIMC ENRIC expects to double both Briggs' revenue and profit over the next five years.

Yu Jiamin, CIMC ENRIC's director for strategic development, said with global industry upgrading and the impact of "Made in India" in recent years, the traditional mode of low-end mass production could hardly meet global manufacturing demands.

"Chinese enterprises need to absorb quality resources from global brands through overseas merger and acquisition activities, and build core strengths on brand, technology and talent rather than low-end manufacturing, making technological upgrading faster and localizing global operations," said Yu.

The ministry said private and non-State-owned enterprises accounted for 86.6 percent of China's mergers and acquisitions activities between January and September.

"Chinese companies, especially from the private sector, increasingly understand the importance of overseas investment for long-term development," said Wang Huiyao, director of the Beijing-based Center for China and Globalization.

He said this has led to greater diversification in the industries involved in China's outbound direct investment, a new feature in recent years.