Forces tug on shoppers' purse strings

By Wang Zhuoqiong ( China Daily Europe ) Updated: 2014-02-28 08:44:15The Paris-based company warned that a sales decline in China would weigh heavily on the group's profits.

"There will be a recovery, but we don't know when and how," Chief Executive Officer Pierre Pringuet says.

Pringuet said he remains hopeful the group will return to double-digit growth in China but the glory days of Chinese consumers sipping $2,000-a-bottle brandy may be over.

In January, Unilever Plc, which makes Ben & Jerry's ice cream and Dove soap, warned of uncertainty in emerging economies that likely will hold back growth.

The Anglo-Dutch company, which gets nearly 60 percent of its revenue from China, India and other emerging markets, said underlying sales growth fell to 4.3 percent from 6.9 percent a year earlier, the first drop recorded since 2009.

Snack maker Mondelez International Inc, based in Chicago, said organic sales grew 1 percent in Europe in the fourth quarter but dropped 6.1 percent in the Asia-Pacific region because of lower pricing across most of the region and a decline in China, where revenue had a mid-teens percentage decline.

Despite the policy shift and stagnant macro-consumption environment, Yu of Kantar Worldpanel cited a lack of competitive strategy as the major cause for weakened growth in the foreign consumer industry.

According to Kantar Worldpanel, in the past quarter, local retailers continued to see stronger performances than their foreign rivals.

But brick-and-mortar retailers continued to struggle as shoppers increased their visits to other channels, such as e-commerce, where prices and convenience are more competitive.

Among hypermarkets and grocery stores, the growth rate of international chains lagged behind local outfits with more adaptable strategies.

French grocer Carrefour SA reported a 1.4 percent increase in its fourth-quarter financial results, which was lower than its third-quarter results.

Because of a slowing consumer environment, sales generated by stores open for at least 12 months were down 3.1 percent. Carrefour's 2013 sales grew by 2.5 percent to 84.3 billion euros ($115 billion).

Yu suggested mergers and acquisitions would boost the revenue of international consumer companies in China. Last year, Yinlu, bought by Nestle, enjoyed a particularly strong year, helped by its new premium congees.

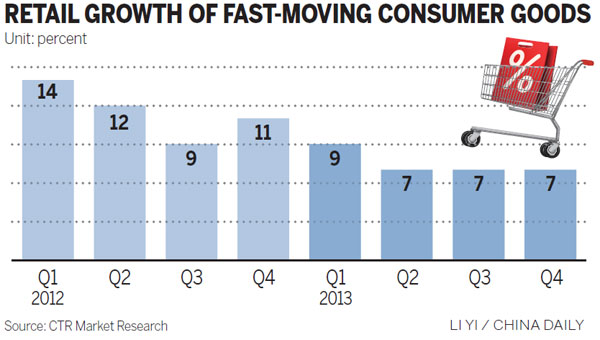

Purchasing power was released in the fourth quarter of last year. Yu expects the overall fast consumption market will slowly recover this year if there are no further negative policies.

Urbanization and China's new second-child policy should stimulate the consumer market, he said.

"The fast consumption market of 2014 is expected to grow 8 or 9 percent based on the increase of consumers' incomes," Yu said.

According to the Ministry of Commerce, in January the consumer market was fueled mostly by holiday shopping.

Based on 5,000 key retailers monitored by the ministry, sales of food and beverages have increased 19.6 percent and 22.4 percent. The growth rates are 8.3 percentage points and 12.2 percentage points higher than that of a month ago. Sales in apparel have been up 13 percent, 9.5 percentage points more than those a month before.

Supermarkets and department stores have seen sales grow month-on-month by 16.5 percent and 14.6 percent, respectively.

Most of the recovering forces of the consumer market last year were highlighted in communication products such as smartphones and e-commerce with strong Singles' Day sales, she said.

The improving consumer market also was boosted by sales in basic sectors such as food, beverages and apparel, which maintained a growth rate of between 30 and 40 percent.

Zhao Ping said consumption growth will hover at about 13 percent this year as a result of the lack of short-term policy stimulus and mild gross domestic production.

Challenges in raising salaries and hiring rates also will cut into the spending power of consumers, she said.

wangzhuoqiong@chinadaily.com.cn

|

|

|

|

|

|

|

|

European Weekly

We will not give up search, Li vows

We will not give up search, Li vows

International hunt for missing airliner continues after fruitless six-day search