China's economy likely to steady during Q2

A Bank of China Ltd report has predicted China's economy will stabilize in the second quarter of this year, with GDP growth forecast to rise from around 7 percent in the first quarter to 7.2 percent in the second.

Zhou Jingtong, a senior economist with the bank's Institute of International Finance, says in the March 30 report that while the economy continues to slow, "we are seeing a series of positive changes emerging from the recent economic moves, such as the rapid growth of private investment and strong profit growth in the equipment and high-tech manufacturing industries".

The tertiary sector of the economy, also known as the service sector, is growing rapidly, making it a main channel for employment, Zhou says. In the first two months of this year, service industry production increased 7.4 percent.

|

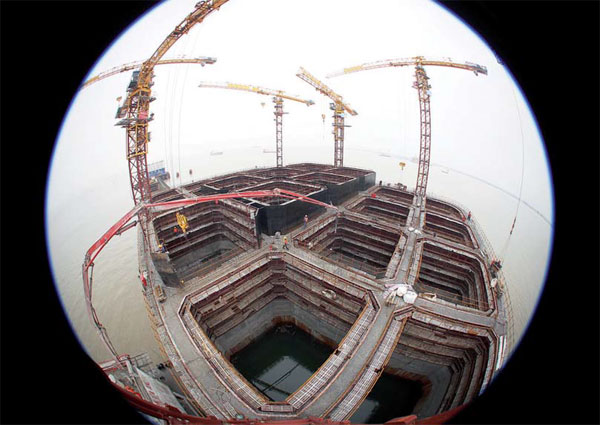

The Shanghai-Nantong Yangtze Bridge under construction on the Nantong side of the river in Jiangsu province. Fixed-asset investment growth further slowed to 13.9 percent in the first two months of this year. Xu Congjun / For China Daily |

Statistics show that every percentage point of GDP growth created 1.79 million jobs in 2014.

The report says consumption rose 11 percent in the first two months, up 20 basis points from the previous year, and its contribution to economic growth is expected to further increase in the first quarter.

During the same period, it also showed that private investment increased 14.7 percent year-on-year and new forms of businesses related to the Internet continued to expand at a high speed. Online sales of products and services increased 44.6 percent from a year earlier to 475.1 billion yuan ($76 billion; 71 billion euros).

Fixed-asset investment, meanwhile, slowed further in the first two months, among which the growth of real estate investment fell 8.9 percentage points from the previous year.

Bank of China's economists says they expect the housing market to remain in a relative trough, "due to a lack of momentum for recovery" in the second quarter.

They expect that the investment in real estate will grow 8-10 percent during the period, compared with 10.4 percent from January to February.

The bank expects new yuan loans to reach 10 trillion yuan to 11 trillion yuan this year, which would help stabilize the economy, and about 3.5 trillion yuan of the total would be extended in the first quarter.

"The central bank will further cut the reserve requirement ratio two or three times to inject liquidity into the market, as China's funds outstanding for foreign exchange will continue to drop this year, thus creating a gap worth 3.5 trillion yuan between base money supply and demand," says Li Jianjun, a financial analyst at BOC.

Analysts have said in recent days that a sharp showdown is possible in the first quarter, after a slew of indicators and forecasts suggested policymakers were under added pressure to maintain GDP growth targets, as structural changes continued to have an effect on the economy.

According to the latest data from the National Bureau of Statistics, industrial profit reached 745.24 billion yuan in the first two months, a 4.2 percent drop compared with a year earlier, after slipping 8 percent in December, 4.2 percent in November and 2.1 percent in October.

The flash manufacturing Purchasing Managers Index for March, jointly released by the HSBC Holding Plc and Markit Ltd recently, showed factory activity unexpectedly dipped to an 11-month low of 49.2 as new orders shrank.

The below-50 reading means that contraction may return to manufacturing businesses amid the persistent weakness in the world's second-largest economy, and increase the risk of deflation.

Contact the writers through jiang xueqing@chinadaily.com.cn and chenjia1@chinadaily.com.cn