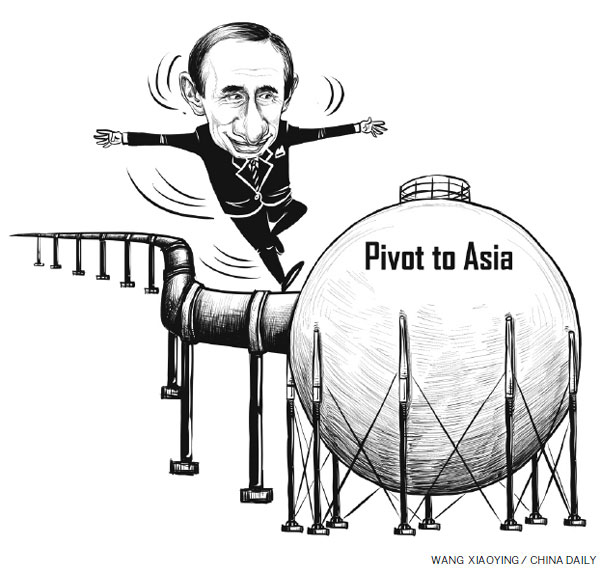

Time for Russia's 'pivot to Asia'

The $400-billion, 30-year natural gas deal just announced by China and Russia is the biggest single trade agreement in history. With this deal, Russia has signaled a major and sharp pivot of its economic and strategic focus to Asia. Russia's "pivot to Asia" and dramatically enhanced relations with China, which this deal and related agreements signify, will have substantial long-term implications for Asia and more broadly for the Asia Pacific region.

China had signed the previous largest natural gas deal with Australia a dozen years ago, worth just $25 billion, the deal runs through to the end of the next decade.

Although accelerated because of some actions taken by the US against Russia and China, the Moscow-Beijing deal has been a decade in the making - and its significance extends far beyond the immediate time horizon.

Important for Russia, the agreement includes a base price formula with reference to oil prices. This is something China had been resisting tenaciously, just as Russia was strenuously holding out for an oil reference price formula to price its gas supply. Through negotiations in the past few weeks, and indeed right up to the final agreement, this was the key, final sticking point.

The pricing of Russia's very substantial natural gas sales to Europe is based on an oil price reference formula. Given the high oil prices, the oil-based price formula for natural gas allows Russia to sell its gas at a higher price than if it were based on spot-market natural gas prices.

Russia is determined to protect this price formula. And had Russia failed to do so with China, Western European countries would have immediately demanded a revision of their natural gas supply contracts with it. In this sense, the agreement is a big breakthrough for Russia.

Beijing and Moscow have said the price will remain a "commercial secret". But it is thought that, in exchange for China having accepted an oil-related price formula, which it had never done before, Russia has agreed to keep the initial price close to what China had been proposing. The agreement includes that Russia cover $70 billion in upfront spending on infrastructure, while China pays $22 billion. Earlier in the negotiations, Russia had proposed a 55:45 split of upfront commitments.

Gas will start flowing into China by 2018, which is significant because it would take another three-to-four years for North American natural gas to be available for shipment to Asia. As part of the agreement, Russia has also accepted the doubling of its oil exports to China to about 1 million barrels a day.

During their two-day meeting in Shanghai, the two countries also announced other agreements, including those on joint production of commercial aircraft and heavy-duty helicopters, as well as joint development in petrochemicals, which indicate the elevation of Beijing-Moscow ties to a higher level and, more significantly, signify Russia's "pivot to Asia".

Russia, however, has more on its agenda. Next on its list is a big energy deal with Japan, which has been in the works for some time. Moscow and Tokyo are working to finalize an agreement by the time Russian President Vladimir Putin visits Japan in September. It's important to note that Japan is the world's largest importer of natural gas and is seeking to diversify its sources of supply.

Japanese buyers are less focused on price than their Chinese counterparts because they include in their calculations the security and stability of supply. So Japan has accepted an oil reference formula for pricing for the natural gas it will purchase.

Apart from the deal with Japan, Russia is preparing to throw a real curve ball at its opponents. Over the last two years, Russia has settled all its outstanding commercial issues with the Democratic People's Republic of Korea, which essentially involved trade debts and other unpaid loans. It has even agreed to forego $10.9 billion in outstanding debts, with the remaining $1 billion to be paid in equal installments over 20 years. In settling these issues, Russia and the DPRK have prepared the base for substantially increased economic relations.

Against this background, Russia's Gazprom and the DPRK's Ministry of Energy have reached an understanding to build a natural gas pipeline that would enter the DPRK at the Khasan crossing of the Tumen River on the Russia-DPRK border. The pipeline would then extend through the DPRK to the Republic of Korea (Korean Gas Co). Tantalizingly, in what is shaping up to be a new case of Russian "gas diplomacy," the pipeline would supply gas both to the DPRK and the ROK. This project has been discussed for more than a decade, with much of the initial impetus coming from Seoul. But Moscow has moved into the driver's seat in the last two years.

A related project would see a modern train line built from the ROK through the DPRK into Russia, and then connecting to the Trans-Siberian Railway. Even more fascinatingly, it would allow high-speed rail connections directly from the ROK to the markets of Europe.

If such a natural gas pipeline and railway are really built - there is strong support for them in parts of the ROK establishment and business community - it would not only provide ROK producers direct land access across Central Asia to Europe; it would also help transform the DPRK's economy and change the region's frozen geopolitics in the process.

In short, if its vision comes to pass, Russia will become anchored in Asia as never before.

Better yet for Russia, all major economies of East Asia would be linked to it in a way few had previously imagined possible. That would truly be Russia's "pivot to Asia". But, at the same time, Russia could get enmeshed in East Asia in ways that could pose new challenges for itself.

The author is chairman of Starfort Holdings and managing partner of Courtis Global & Associates.

The Globalist.