Is wind power running out of puff?

China's new-energy sector is facing an uncertain future after the US imposed swingeing import tariffs and demand for equipment dwindles, as Jiang Xueqing and Hu Yongqi report from Beijing.

On Dec 18, the US Department of Commerce imposed stiff tariffs on Chinese-made wind towers imported at prices deemed to be unreasonably low. The department determined that Chinese exporters have sold utility-scale wind towers in the US at dumping margins of 44.99 percent to 70.63 percent. In response, the department set deposit rates for cash, used as surety for goods, ranging from 34.33 to 60.02 percent on the towers and additional countervailing duties of 21.86 to 34.81 percent to offset Chinese government subsidies.

"With rates of duty like this, it's impossible for the products of Chinese wind tower manufacturers to enter the US market," said Zheng Kangsheng, secretary of the board of Titan Wind Energy (Suzhou) Co. "The company's US market share will definitely decline sharply," he added.

A 2012 US investigation into anti-dumping and countervailing duties found that Titan Wind Energy gained sales revenue of 363.91 million yuan ($58.4 million) from its US exports of utility-scale wind towers in 2011, accounting for 38.64 percent of its operating revenue that year. The company will now attempt to expand its market share in Europe, the Asia-Pacific region and Africa to offset the predicted losses in the US, said Zheng.

The department's decision has added to the tough times being experienced by Chinese wind power equipment manufacturers as a result of overcapacity.

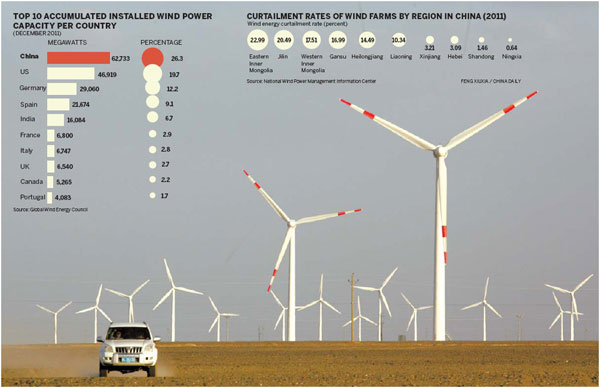

By the end of 2011, China's total installed wind power capacity was 62.36 gigawatts, the largest in the world. However, just 47.84 gW, or 76.7 percent, was connected to the grid, according to China Wind Power Outlook 2012, a report issued by the Chinese Renewable Energy Industries Association, Greenpeace and the Global Wind Energy Council.

"In the past few years, wind farm development has been too rapid and grid construction has not been able to keep up. The huge gap put a lot of pressure on the grid," said Ma Jinru, vice-president and secretary of the board at Goldwind Group, one of China's biggest manufacturers of wind power equipment.

The report also showed that more than 10 billion kWh of wind-generated power had been curtailed across China. The number of wind turbine working hours declined sharply in 2011. Full-load hours for the year came to 1,903 hours, a decline of 144 hours, or 7 percent, from the 2,047 hours recorded in 2010. Wind farm operators suffered combined losses of more than 5 billion yuan as a result of the curtailment, which cut profits in the sector by half.

China Ming Yang Wind Power Group, one of the world's top 10 wind turbine manufacturers by sales, reported a gross profit of 137.2 million yuan in the third quarter of 2012, a fall of 55.1 percent from 305.6 million yuan for the corresponding period in 2011, blaming weak demand for wind turbine generators in China. Sinovel Wind Group Co, another leading Chinese manufacturer in large-scale onshore, offshore and inter-tidal wind turbines, reported a net loss of 280.3 million yuan during the same period.

Indefinite 'vacation'

In November, Sinovel announced that it had put 350 workers on indefinite "vacation", accounting for 12 percent of its total workforce. For the first month of the suspension, the employees received full salary, but after this the payment declined sharply to 1,008 yuan, around 80 percent of the minimum monthly wage set by the Beijing municipal government. No one knows when the "holiday" will end, but the number of staff members "on vacation" has risen to approximately 500, according to employees.

"We were not told when to return to the office, and many workers like me are looking for a new job," said 24-year-old Wang Yiran, who has worked in Sinovel's marketing department for 18 months. He said the so-called holiday actually meant unemployment for him.

In 2011, Wang declined a number of good job offers in his hometown of Harbin, capital of Heilongjiang province, and opted to work for Sinovel in Beijing.

"I didn't know much about Sinovel until I signed the contract with the company. The only thing I knew was that it's one of the largest wind turbine manufacturers and it offered me a good salary," he said. "The day I started with the company, I was impressed by the smiles from the receptionists, the free lunch and the professional training. I thought I had made the right decision."

His opinion changed when 15 colleagues in the marketing department were made redundant in November after falling profits prompted cutbacks. The office was full of rumors that more employees would be "let go", leading around 40 members of the marketing staff to find alternative employment in the first six months of 2012, according to Wang.

"At that time, I still had hopes of living in Beijing because I could make 6,000 to 8,000 yuan a month, depending on my performance. But now I've moved back to Harbin because 1,000 yuan was nothing in Beijing," he said. "Many colleagues said the company just wanted us to quit our jobs so it wouldn't have to pay redundancy compensation."

Bare-chested protests

On Nov 29, some 20 male research and development engineers who were part of the group forced to go "on vacation" staged a protest at Sinovel's Beijing headquarters, standing bare-chested in the snow to attract public attention.

The company also cancelled prospective employment agreements with a number of graduates in 2012, including Yin Wei, aged 24. After four years of studying at North China Electronic Power University in Beijing, one of China's leading schools in the power industry, Yin felt his employment prospects were good and signed an agreement with Sinovel in September 2011, when many of his peers were just starting to search for jobs. Sinovel offered an annual 3,000 yuan for interns and around 2,000 yuan more for full employees, a salary that satisfied Yin.

However, in May 2012, as Yin was celebrating graduation with friends, he was told the agreement had been terminated. With compensation of 2,000 yuan, Yin and two classmates were forced to return home to find jobs.

"I was confident and proud to be a member of Sinovel at first, but the cancellation (of the agreement) changed my career and life," said Yin. "It was too late to find a high-quality position, because most companies had completed their recruitment by May."

Eventually, Yin found a job with a transmission-tower manufacturer in his hometown of Chengdu, capital of Sichuan province. "I'm extremely interested in facilities research and development, but in the new factory I can't choose what I do, and my gross salary is no more than 2,000 yuan a month, a mere 40 percent of what I had expected," he said.

A member of Sinovel's press relations team declined to answer questions put to her by China Daily.

"Sinovel has made great forward strides in the past few years, but the foundation of its development is not solid enough," said Ma Xuelu, vice-chairman of the China Wind Energy Association. "The company focused on expanding production capacity rather than making the necessary technical innovations. This is a typical phenomenon in the Chinese wind power industry."

In addition to the lack of innovation, the adjustment of industrial policies, and fierce competition, are also blamed for the sectoral profit slump.

Also, a number of local governments that approved wind farm construction to pursue GDP growth have ignored the fact that the local grid network lacks the capacity for long-distance power transmission.

Provisional regulation

To control the development of the wind power industry, China's National Energy Administration issued a provisional regulation in August requiring that any future plans for wind farms with a capacity of at least 50,000 kW must obtain approval from the central government as well as the provincial authorities.

When considering projects with a capacity of less than 50,000 kW, provincial governments have to make a decision based on their annual plans for wind farm construction and development. The plans, which are submitted to the National Energy Administration, should include the total construction scale and a separate application for each project.

By Dec 18, the NEA had approved plans for wind farms with a total capacity of 54.11 gW.

"The Chinese wind power industry has developed too quickly during the past five years and a large number of companies, some without the requisite experience or skills, have entered the industry," said Ma Jinru of Goldwind.

"Many wind turbine manufacturers bought technical drawings to rapidly accelerate their production capacity and start commercial production, but the wind turbines they produced were far below international quality and performance standards."

The chaos that followed resulted in a drop in the price of wind power equipment. The average price of a 1.5 mW wind turbine - the model most frequently used in China - fell to 3,800 yuan per kilowatt by the end of September 2012 from 6,000 yuan in 2008.

As competition intensifies and the government raises the technical bar for wind farms to connect to the grid, industry experts predict that a larger number of companies will be forced out of the sector in the next three years. In the meantime, China will remain as a major global market for wind energy equipment manufacturers.

Wu Wencong contributed to this story.

Contact the reporters at jiangxueqing@chinadaily.com.cn and huyongqi@chinadaily.com.cn