|

|

A worker connects electric cables at an offshore oil engineering company in Qingdao, Shandong province. [Photo/China Daily] |

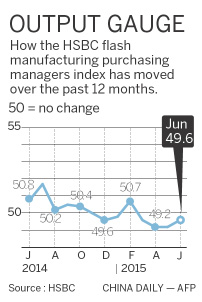

The HSBC flash manufacturing purchasing managers index for June stood at 49.6, a slight improvement on the 49.2 in May but still below the 50-point mark that distinguishes expansion from contraction.

Annabel Fiddes, an economist at global financial information provider Markit, said the latest PMI survey provided a mixed bag of data for June.

On the one hand, the sector showed signs of improvement as output stabilized amid a slight pickup in new work, while purchasing activity also rose slightly during the month.

On the other hand, manufacturers continued to cut staff numbers, with the latest reduction the sharpest in more than six years.

Tom Orlik, chief Asia economist at Bloomberg, warned against reading too much into slight movements in a small sample survey, saying that a 0.4-point improvement could represent a change of view by just a handful of companies.

Other preliminary readings for June also presented a complex picture.

Market News International's business survey showed a recovery to 53.5 from 49.7 in May, the highest level since January. However, metal markets were less encouraging, with falling steel and copper prices pointing to lackluster demand.

HSBC and Bloomberg economists said the temporary recovery is fragile, prompting a case for continued policy easing and expectations of a fourth interest rate cut in the third quarter.

However, Liang Hong, chief economist at brokerage China International Capital Corp, expects growth to stabilize in the next two months and stage a moderate recovery at the end of the third quarter and in the fourth quarter.

"We expect a 200-basis-points reduction in the reserve requirement ratio (the amount of cash banks are required to hold as reserves) within this year, but the central bank will probably not cut the benchmark interest rate anymore in 2015," Liang said.

Economists generally agreed that a greater role for fiscal policy is needed to counter the downward cycle.

The State Council has said it will step up effective investment in key sectors to support growth. After a regular meeting last Wednesday, it said the government will increase investment in transforming shantytowns and dilapidated houses and also boost investment in rural electricity infrastructure and grain storage facilities.

A three-year plan to renovate 18 million dilapidated urban houses and 10.6 million dilapidated rural homes was announced.