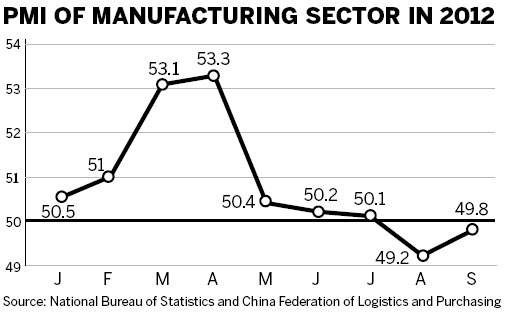

The official manufacturing purchasing managers' index for China rose slightly in September, signaling the first upturn after four months of successive declines.

However, manufacturing activity contracted for a second straight month, indicating that the economy is still slowing.

China's PMI rose to 49.8 in September from 49.2 in August, according to the National Bureau of Statistics and the China Federation of Logistics and Purchasing on Monday.

A reading below 50 indicates contraction, while one above that level indicates expansion.

August's PMI figure was the lowest since November 2011, indicating that the country is still in the grip of an economic downturn.

The September sub-indexes in most sectors - especially for new orders and raw material inventories - also rose, suggesting that policies to stimulate economic growth are taking effect, said the bureau and the federation in their statement.

The September sub-index for new orders, the main driver of the PMI rebound, rose by 1.1 points to 49.

Demand for tobacco, food, beverages, clothing and electronic appliances increased, but refined metals, special equipment and steel remained at a low level.

China's steel industry has been in the doldrums since October 2011. That's as the central government's tightening policies on the real estate industry have affected the domestic demand for construction steel.

Hampered by the high price of raw materials, overproduction and falling demand, steel companies have reported huge losses since the first quarter.

September and October are usually busy months for the industry, but analysts said things will be quiet this year and most steel producers will report losses again when September's results are released.

The output sub-index rose 0.4 points to 51.3, meaning that manufacturing production is rising.

The tobacco, clothing, food and information technology sectors are seeing output increase, but the sub-indexes for steel, printing and refined metals are still below 50, indicating a decline in September.

The PMI for large-scale enterprises was 50.2, 1.1 points higher than in August. Meanwhile, the reading for small businesses fell by 0.1 points month-on-month to 49.8 and medium-sized enterprises saw a month-on-month decline of 1.0 to 46.7.

The employment sub-index fell 0.2 points to 48.9, the fourth successive month below 50, reflecting ongoing job losses in the manufacturing sector, with metals and autos bearing the brunt of the downturn.

The purchasing price index for raw materials rose to 51.0 in September from 46.1 in August. The previous four months all had readings below the midpoint 50 figure.

Prices of raw materials are still rising in some industries, especially oil refining and chemicals.

However, raw material prices for the steel and metals industries are falling. The purchasing price index for raw materials in those industries was below 40.

An independent PMI figure released by HSBC increased slightly to 47.9 in September from 47.6 in August, a nine-month low.

The HSBC survey is heavily focused on small and medium-sized companies.

Economists said China's economy is still facing difficulties.

"The data continues to reinforce the hard landing that we have predicted for China, because this is the second consecutive month of a sub-50 reading," said Prakash Sakpal of ING in Singapore, quoted by Reuters.

Sakpal forecast that economic growth will be around 7 percent in the third and fourth quarters.

dujuan@chinadaily.com.cn