Europe in the grip of protectionist mood

|

|

ZHANG YONGWEN/CHINA DAILY |

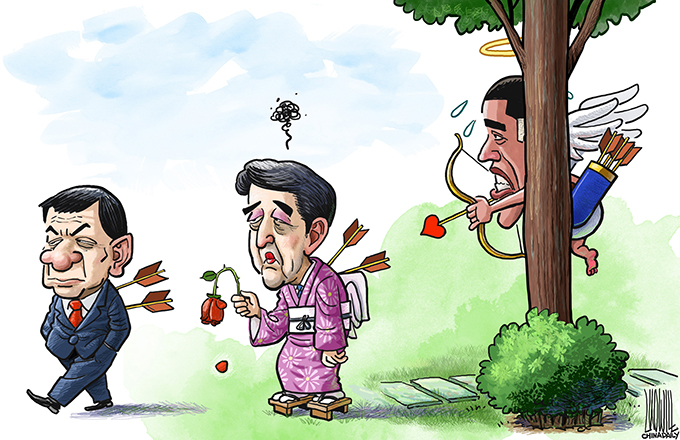

Would-be Chinese investors in Europe are encountering a growing mood of protectionism among politicians and officials there who have raised barriers against many major deals. This is generating pressure to tighten the rules on Chinese takeovers, particularly where issues of fair competition and national security are said to be involved, and is twinned with demands for greater European access to investment opportunities in China.

The trend has been particularly apparent in Germany, whose Vice-Chancellor and Federal Minister for Economic Affairs and Energy Sigmar Gabriel upped the rhetoric ahead of a visit to China this past week by claiming it was strategically buying up German companies while protecting its own companies against foreign takeovers.

"Nobody can expect Europe to accept such foul play by trade partners," he wrote in a signed article in Germany's Die Welt newspaper. It was an unusual tone for an official to adopt before an overseas economic mission whose agenda included opening Germany's biggest business conference outside its own borders.

However, it received a conciliatory response from Beijing. "We have noticed relevant reports from German media," Foreign Ministry spokesperson Hua Chunying said, adding: "China is willing to cultivate a fair and transparent investment environment for investors both at home and abroad, including those from Germany." Perhaps more significant than Gabriel's somewhat undiplomatic language are some of his recent actions. He recently blocked a $735 million (€671 million) buyout by Chinese investors of the German semiconductor maker Aixtron.

The protectionist mood is not confined to Germany. The European Commission, the executive arm of the European Union, last month delayed the planned acquisition of Swiss agribusiness Syngenta by China's ChemChina by announcing an in-depth inquiry into the deal. The probe is ostensibly aimed at deciding whether the deal would reduce competition in the pesticides market and raise prices for farmers.

To try to salvage the deal, State-owned ChemChina has extended its $43 billion cash offer until Jan 5 in the hope of gaining European regulatory approval.

By putting obstacles in the way of these and other major deals, European officials may be responding to a public mood in their electorates, fueled by headlines that accuse China of dumping steel, solar panels and other products on the European market and stealing European jobs.

The mood of protectionism comes at a time when the EU has been rattled by the consequences of Britain's vote to exit the economic bloc. British politicians who advocate a clean break with EU institutions such as the European single market have been the most vociferous in promoting the benefits of closer economic relations with China.

It also comes at a time when the EU is pondering tightening its so-called trade defense instruments to introduce more robust anti-dumping measures that would impact Chinese exporters. New proposals on how to calculate anti-dumping tariffs on Chinese goods are expected by the end of the year.

Other moves include an attempt by the German government to increase its powers to block takeovers. The current law allows the government to block takeovers only if they threaten energy security, defense or financial stability. Gabriel is pressing for EU safeguards to stop foreign takeovers of technology companies seen as strategic to Europe's future economic success.

Such protectionist moves have not generally been welcomed by the business community. "For many German companies, China is now the single most important market," Thomas Heck, head of the China business group at PricewaterhouseCoopers in Germany was quoted as telling Reuters.

"It may not be wise to pick a battle and tell China 'If you don't open up your markets like we have, then we will shut down our economy for you'."

One signal of a tougher line on Chinese deals came earlier this year when British Prime Minister Theresa May delayed approval of a nuclear plant at Hinkley Point in which State-owned China General Nuclear would have a one-third stake.

She announced the delay as soon as she took office in July so that she could familiarize herself with the terms of the deal. In a more positive signal to Chinese investors, by September it was approved.

The writer is a senior media consultant for China Daily UK.