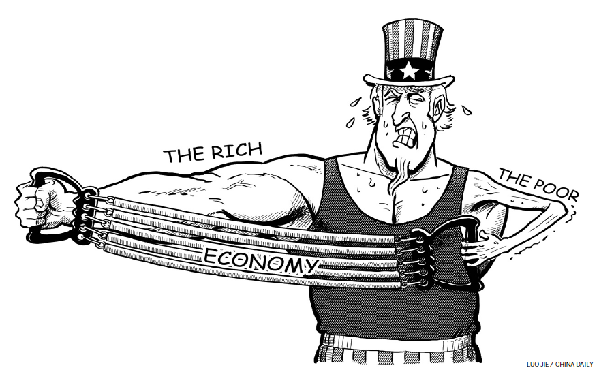

Income gap the bane of US

US President Barack Obama has just committed himself and his administration to fighting the scourge of income inequality. Indeed, it is not a moment too soon to focus on this issue.

The United States' recovery has been incredibly unequal, with the incomes of the richest 1 percent growing robustly, while those of the bottom 99 percent are stagnant. For a long time, few economists - even those who worried about inequality - have deliberated this topic in the context of macroeconomic policy.

As it turns out, high and rising levels of inequality may well be a cause of increased macroeconomic instability. But the negative spiral doesn't end there; high inequality also contributes to a fraying of the political consensus, is associated with boom-bust credit cycles and may ultimately lead to a chronic weakness of economic demand.

The US is now caught in a vicious cycle. The cycle starts with stagnant incomes and a biting credit constraint (there is no other word to put it appropriately) at the middle and low end of the income distribution. As dramatically exemplified by the large numbers of continuing and still unresolved home foreclosures, this has led to low expectations for effective demand growth - and therefore low business investment in the US economy at large.

The US Federal Reserve has been trying to stimulate demand via monetary policy with very low interest rates or "quantitative easing", or with both. However, these measures have been of dubious efficacy. According to the old adage, you can lead a horse to water, but you can't make it drink.

In addition, there is a pronounced risk of re-igniting an unsustainable borrowing process. The bottom 90 percent of American households, with incomes still stagnant, is not yet in a considerably better position to borrow. Yet this is what is heralded - whether to pump up car sales or whatever else.