Looking for union from 'accord of men'

For quite sometime, Shanghai has been talking about becoming an international financial center on par with New York and London. The proposed free trade zone in the city is widely seen to have the potential of bringing its dream a big step closer to reality.

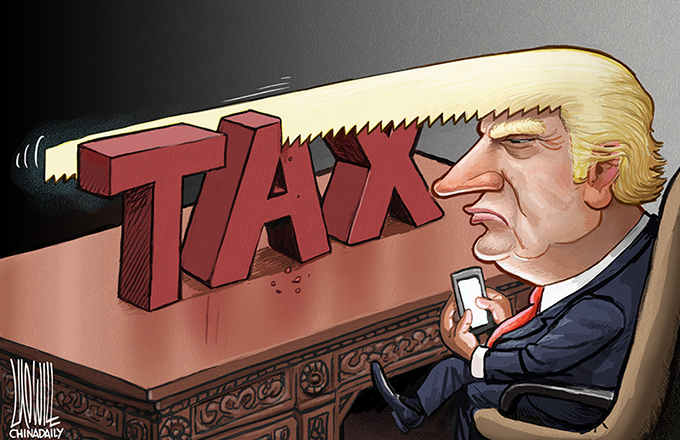

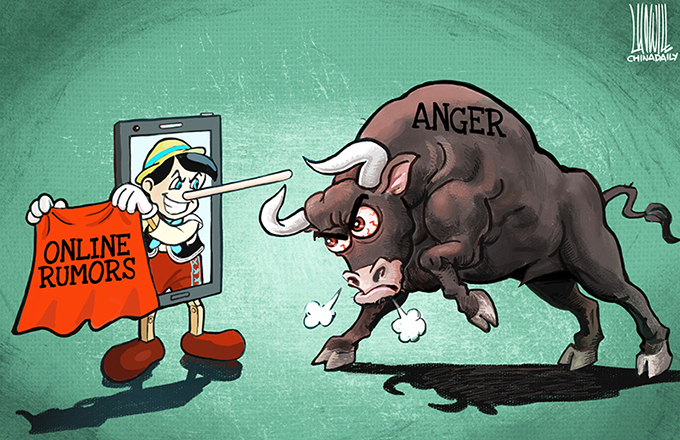

After the green light was given for the project last month, many economists and commentators have enthused about the many possibilities and predicted resounding success even though details of the plan have yet to be announced. Their comments in the media and on the Internet suggest that modern infrastructure, friendly rules and tax incentives are all that needs to create an international financial center. That's overly presumptuous.

Both Hong Kong and Singapore, which are well-established international financial centers in the region, recognized long time ago that an international financial center was built by institutions and their people more than anything else. The Singapore government invited Bank of America to establish a US dollar offshore market from which other financial services were spawned. In Hong Kong, the influx of foreign banks, including numerous merchant, or investment, banks in the 1980s to do cross-border lending and other financial businesses, underscored the city's success.

These foreign institutions brought with them not only the expertise they had accumulated in other markets, but, more importantly, global clients, including many multinational companies and large enterprises in various regional economies. Without such an international client network, it would have been impossible for a regional syndicated loan market to take hold in Hong Kong.

Of course, the large domestic institutions, notably HSBC in Hong Kong, were active participants in the building of the financial center from the start. But it didn't take long for the other smaller domestic banks to jump on the bandwagon as fund providers at first and co-managers at a later stage. In the process, they too have acquired the financial strength and expertise to compete with the big boys for a piece of the business.