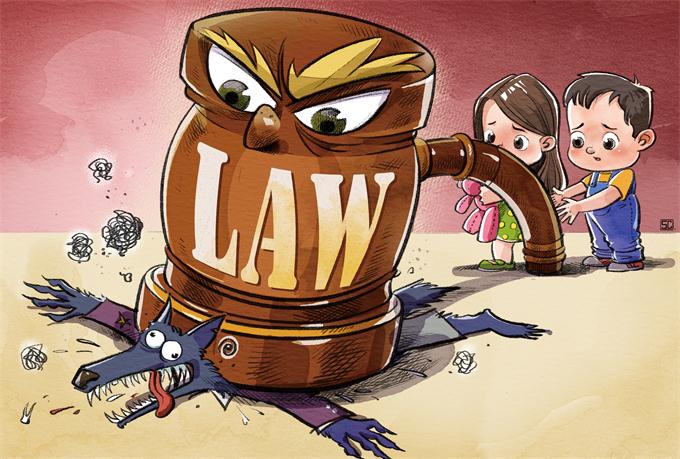

Taxation law must be enforced

The law on taxation must be enforced together with the tax distribution reform, says an article of the 21st Century Business Herald (excerpt below).

The slowdown of economic growth directly affects the government's financial revenue. Local governments started collecting "tax in advance" and arbitrary fees.

Lawmakers decided to amend the Administration Regulations of Tax Collection and collect opinions from the public. The tax authority should take the opportunity to address the problem of "tax in advance" and arbitrary fees and raise local governments' and public awareness of the legal bases of taxation.

China has the Budget Law. But China lacks a government accounting system that enables the government to create budgets according to their revenues. Under these circumstances, the taxation authority follows the superior authority's orders to collect taxes, rather than abide by relevant laws and regulations of taxation.

Thus, local governments naturally start collecting taxes in advance to boost their revenue during financial crisis.

Revising the law on tax collection would have a positive outcome, but the law would have to be enforced. The taxpayers should have the rights, abilities and channels to sue "illegal" tax collectors.

The fundamental solution would be to carry out the tax distribution reform between the central and local governments, because local governments are the main public service providers. But they do not have enough legal tax revenue to cover their expenses.

The National People's Congress, China's legislature, should fulfill its responsibilities as the top budget-supervising authority and monitor government's taxation and budget on behalf of the people.