Nation's debt has just turned a corner

Credit is growing in line with GDP, which means more benefit for every new unit of borrowing

There are fears about China's growth prospects given the recent bad news about weak credit demand, high real interest rates and tight liquidity. But we at Standard Chartered see three reasons for at least some optimism:

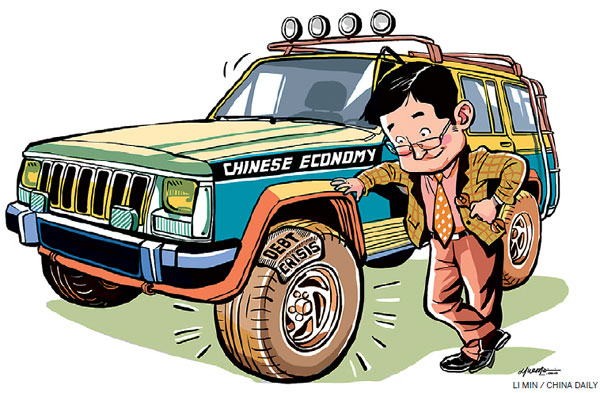

First, China's debt-to-GDP ratio stabilized in mid-2014, albeit at a relatively high 251 percent of GDP. While China's dramatic debt increase in the past five years grabbed headlines worldwide, as the ratio leapt nearly 100 percentage points from 155 percent of GDP, the fact that the ratio has begun to stabilize has not received much attention.

This is an important milestone in China's debt turnaround following years of excess. Over the past five years, total credit growth in China was on average 8 percentage points faster than nominal GDP growth - way beyond the point at which credit growth becomes inefficient for any economy.

However, since mid-2014, China's credit has been growing in line with GDP. Essentially, this means China is now getting more "bang for its buck" for every new unit of borrowing. Also, attitudes toward debt have changed, with loan officials in China now much more averse to taking the risk of a loan going bad.

Although this doesn't mean China's leverage risks have been resolved, because the excessive debt accumulation of prior years still needs to be dealt with, it does mean that debt challenges are no longer escalating. And this is good news.

Resuming past excesses is not an option. China's debt-to-GDP ratio is still relatively high compared with other economies at a similar stage of development, so debt cannot be used to boost growth significantly in the near future without risking even more solvency issues later. Besides, since the official non-performing loan ratio is set to keep rising through 2015 and beyond, most likely not all of the bad debts will be recognized immediately, which comes with both benefits and potential costs.

We will need to watch carefully whether this "evergreening" of bad loans becomes too large a share of new credit growth. Importantly, this does not appear to be the case so far.

The second reason to be a bit more upbeat about China is the sign of positive sentiment among property developers. Results of our recent property market survey of 30 companies in five major cities across China - which we have been running twice a year since 2010 - indicate that the industry will be in better shape by the second half of this year, which bodes well for China's growth.

Developers believe the excessive amount of inventory in lower-tier cities will be worked through by the second half of this year. They also anticipate better appetite for investment in land among their peers before the end of this year. This is good news, too, given the drag on GDP growth from the sector recently.

Finally, our survey of more than 600 small and medium-sized enterprises across China showed a slight improvement in sentiment in January from a low in December. The results indicate that this optimism is being supported by broad-based policy easing in the country. And, as we expect to see more monetary easing in the form of at least two more reserve requirement ratio cuts and a further lowering of policy rates, business confidence could continue to improve.

While we all should be getting used to China's "new normal" of slower growth, we should not be worried about the slowdown deepening even further in 2015 and 2016.

There are many reasons to be less bearish on China than the present consensus, and the fact that there is no unsustainable credit boom, taking off again in China, or anywhere else in the world's major economies, should be a source of relief.

The author is head of Macro Research, Asia, Standard Chartered.The views do not necessarily reflect those of China Daily.