Affordable luxury comes to the fore

Middle class turning away from high-profile expensive brands

Last year definitely ended with two widely differing stories in the fashion world in China, with traditional well-known luxury brands experiencing a downturn while more affordable luxury products and fast fashion brands turning in satisfactory results.

China's luxury market contracted for the first time in 2014, with the total market value slightly down by 1 percent year-on-year to reach 115 billion yuan ($18.34 billion), according to consultancy firm Bain & Company. Sales of luxury watches dropped the most significantly by 13 percent last year, while menswear dropped 10 percent.

This can be largely attributed to the continuing impact of Beijing's anti-corruption and frugality campaigns. The country's economic slowdown also exacerbated the issue, according to Bruno Lannes, a partner with Bain & Co.

Alain Li, regional chief executive officer of Richemont APAC, said that the company, which is known for its luxury watch and jewelry brands, witnessed healthy growth in China before 2014. However, last year was the first time that it witnessed a decline in the Chinese market, mainly affected by the rise of daigou, or overseas shopping agents, as well as the exchange rate, which means that more Chinese are making luxury purchases overseas.

The situation for Italian brand Prada is even worse. Even though the company saw some recovery in the sluggish European market in the first three quarters with the rate of decline gradually narrowing, its sales in the Asia-Pacific region continued to deteriorate throughout 2014.

If calculated by fixed interest rates, its sales revenue declined by 7 percent last year, mainly due to worsening sales in the fourth quarter in China. As a result, the entire group's sales dropped 1 percent in 2014 to 3.5 billion euros.

The reason for the decline of these traditional luxury brands is consumer preference. As discovered by Bain& Co, rather than celebrated brands such as Louis Vuitton, Gucci and Prada, Chinese consumers have expressed a willingness to buy less known emerging luxury brands, with more than 80 percent of the 1,400 polled consumers saying they had such plans over the next three years. Brands such as Balenciaga, Michael Kors and Kate Spade have become more attractive to Chinese consumers.

In addition, logos continue to be less important as Chinese consumers become increasingly sophisticated. About 28 percent of the surveyed consumers considered luxury goods with an obvious logo as too high profile. Another 18 percent considered them outdated or even tacky. More than 20 percent of the total interviewed consumers said they would not buy products with visible logos in the future.

It is also interesting to notice the shifts in magnitude and dominance among the top five brands in the monitored sectors. Brands which offer less expensive products were easily found in sectors such as cosmetics, watches and leather goods. As a result, Kiehl's Tissot and Coach were rated among the top five in their respective industry.

The reason for the change is quite simple. In 2013, the buzzwords defining the luxury industry used to be outlet, quality, traditional brands, etc. However, the keywords for 2014 were fashion, style, value for money, exclusivity, etc.

More importantly, the rise of the Chinese middle class has also contributed to the success of more affordable luxury products. According to Zhou Ting, director of the Fortune Character Institute, which studies the luxury industry, China already has a middle class, which means that the market has to be more sophisticated in order to cater to their needs.

According to market consultancy company McKinsey& Company, around 76 percent of Chinese households will reach the middle-income level in 2022, while the figure was only 4 percent in 2000. By 2022, the annual disposable income of each of these families will be between 60,000 yuan and 229,000 yuan, which is equal to the level in Brazil and Italy.

As McKinsey has found out, the Chinese middle class is willing to spend more time and money on recreational activities and tourism. Products or services which stress emotional and social aspects will gain more preference. Meanwhile, the Chinese middle class is becoming more inclined to overseas brands.

The continued growth of the Chinese middle class, especially the upper-middle class, will lead to a "more mature and attractive" market for businesses, according to the consulting firm.

As a result, overseas brands, especially those in the fast fashion industry, are seeking rapid development in China.

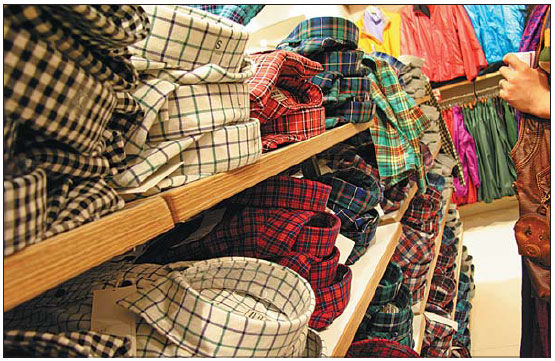

Japan's Uniqlo is undoubtedly the most aggressively expanding fast fashion brand in China. As of the 2014 fiscal year which ended on Aug 31, the company had a total of 374 stores in China, among which more than 80 had opened last year. Last year, during the Chinese online shopping carnival Singles' Day - which falls on Nov 11 every year - Uniqlo came out on top among garment companies, notching up online sales revenue of 260 million yuan.

Swedish fashion giant H&M also saw its net profits rise 17 percent to 19.98 billion kronor ($2.44 billion) in 2014 while sales increased 18 percent to 176.62 billion kronor.

The strong earnings came on the back of massive expansion, with the chain adding 379 stores in 2014, mainly in the United States and China, bringing its total network to more than 3,500 outlets in 55 countries and regions. New online stores in France, Spain, Italy and China also posted strong returns, the group said, adding that similar launches are planned for eight European countries in 2015.

"The year 2014 has been a very good year for H&M. Well-received collections for all our brands and continued strong expansion both in stores and online have helped increase our market share," Chief Executive Karl-Johan Persson said.

US sportswear manufacturer Columbia saw its sales grow by 15 percent to $79.8 million last year, with incremental net sales of about $44.1 million coming from the company's joint venture in China.

Tim Boyle, Columbia's president and chief executive officer, said that "2014 was an outstanding year for Columbia Sportswear Company". Looking forward to 2015, the company expects operating profit to grow at a rate faster than sales growth.

shijing@chinadaily.com.cn

|

Shirts of different colors on shelves at a Uniqlo store in Beijing. The Japanese fast fashion brand is aggressively expanding its market share in China. Provided To China Daily |

.

.