Banks see an opportunity in overseas education boom

The growing population of Chinese students overseas means opportunities for financial institutions to serve this client group.

There were 413,900 Chinese students attending overseas schools last year, up 3.6 percent from a year earlier, according to the Ministry of Education. But it was the first time in five years that the growth rate fell into the single-digit range.

Standard Chartered Bank offers services for Chinese students preparing to study abroad. "Our services fall into three parts based on the different stages of the overseas study plan: before, during and after," said Wei Jia, regional alliance manager for northern China of Standard Chartered Bank.

|

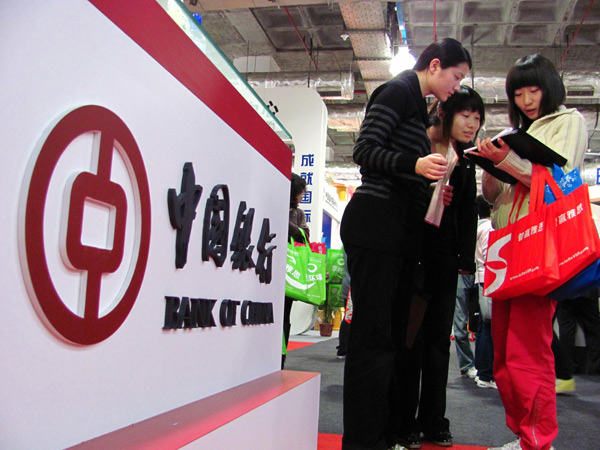

Visitors to an education exhibition in Beijing are drawn to the stand of Bank of China, which offers overseas education loans in a number of foreign currencies including the dollar, euro, pound, yen, Australian dollar, Hong Kong dollar and Canadian dollar. Wu Changqing / For China Daily |

Pre-arrival account opening is one of the services provided to students who have received offers of admission.

Standard Chartered can help clients open overseas bank accounts in the countries where its network has coverage, including the US, the UK, Japan and Australia.

These clients can have access to other free services provided by the London-based bank, such as free overseas ATM withdrawals and emergency reserve funds, said Wei. The bank has different partners in various countries to help it provide services.

Apart from these services, it also offers visits to its branch banks and partner companies to clients meeting certain requirements - basically, according to the amount deposited with Standard Chartered.

"The visits give students who apply for business-related majors in overseas universities a chance to know more about how a bank technically operates, what different departments contribute to the whole institution," said Wei.

It's not an internship, Wei emphasized.

The bank's business in this sector grew more than 50 percent in 2013, and it is expected to grow further in the years to come.

"The growth of our clients in the area is kind of guaranteed because a majority of clients seeking immigration-related services at our bank will have demand for overseas study-related financial services for their children," said Wei.

Citibank also provides services to assist Citigold customers and their children at different stages of preparation for overseas study. For example, after applicants obtain visas, Citibank will provide a variety of services such as pre-arrival account opening referrals, free cross-border remittances, annuity insurance and a tailor-made plan to accumulate education funds. It also offers a preferential exchange rate.

While clients or their children are studying abroad, the bank provides free global ATM withdrawal services and dedicated multilingual relationship managers locally and abroad to help the customers.

Domestic banks are also targeting this market, and they are having some success.

Bank of China Ltd launched a special service in 2009 by offering overseas education loans in a number of foreign currencies such as the dollar, euro, pound, yen, Australian dollar, Hong Kong dollar and Canadian dollar.

The amount of foreign currency a client could borrow usually does not exceed 80 percent of the tuition and living expenses abroad, and it's limited to the equivalent of 1 million yuan ($160,845). The duration of the loans varies from one year to six years, extending to 10 years at most. In 2013, Bank of China provided 1,262 clients with overseas education loans, extending 327 million yuan.

"As the yuan kept rising against the dollar in recent years, a growing number of Chinese people realized that they could manage their money better by applying for loans rather than using their savings to pay for overseas education.

"Mostly, the borrowing rates for foreign currencies are lower than for yuan loans. These factors have brought a significant increase in our loans to students studying abroad since 2012," said Zheng Yang, who works in the personal financial services department of Bank of China's Beijing Branch.

Apart from providing education loans and traditional currency-exchange services, the bank also helps students open an account in their destination country before they arrive and helps them with student visa applications in seven countries including the UK, Canada and Singapore.

Last summer, the bank launched 90-day travel accident insurance, which has been very popular among students who are going to Europe.

Wei from Standard Chartered Bank said that there is huge potential in the overseas study market in many second- and third-tier cities, because some banks have yet to offer these services nationwide.

So far, among the 22 branches where Standard Chartered runs its business nationwide, the cities reporting rosy business growth in this area include Suzhou, Nanjing, Hangzhou and Qingdao, according to Wei.

Contact the writers athuangying@chinadaily.com and jiangxueqing@chinadaily.com.cn