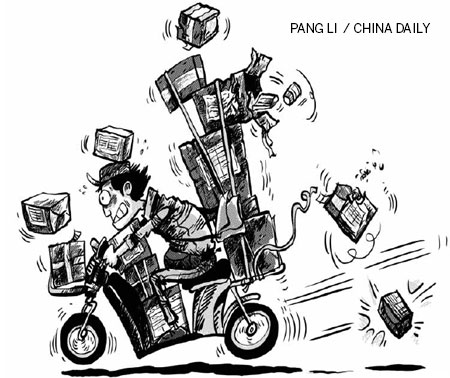

Express delivery at people's service

China, according to reports, may become the largest express delivery service country in 2014. But the fast growing express delivery sector still has many loopholes, as was evident last month when packages soaked in a deadly chemical killed one recipient in Shandong and left seven critically ill.

The growth of China's express delivery industry has been amazing. In the first 11 months of this year, the industry had delivered 8.12 billion packages, second only to the United States. The industry has grown at such a fast pace because of the astonishing development of e-commerce coupled with China's gift-giving tradition. The volume of e-commerce has grown from 10 billion yuan ($1.65 billion) in 2000 to about 10 trillion yuan in 2013, a 1,000 times increase.

According to data from Taobao and Tmall, on Nov 11 alone, more than 70 million packages were wrapped for delivery. Alibaba Group's figure show that the about 7 million shops on Tmall and Taobao need to send 5 million new packages every day. E-commerce indeed has been the greatest driving force for the express delivery industry.

China's traditional gift-giving culture, too, has played a big role in the industry's stunning growth. Since gifts, especially during festivals, carry great cultural value in China, people in cities quite naturally choose express delivery agencies to send them to their loved ones. The changes in people's living and working styles, too, have helped the express delivery business to boom.

The industry today is more competitive than ever, with courier agencies opening more branches in more cities across the country to fight for a bigger market share. Behind this booming market, however, lie potential risks.

The lure of winning a larger market share - and conversely the fear of losing customers - has prevented the delivery agencies from raising their charges. The result: express delivery charges have not risen for years, a rare market phenomenon considering that inflation and higher labor costs have pushed up prices of almost all products. That means the industry, owing to increased operational and labor costs, is facing a very tight cash flow.

To overcome the above constraints, some delivery agencies have chosen to invest more funds into their business while others have introduced franchise operations or raised their business commission.

The problem is that, once the national delivery demand slows down, such large-scale expansion could cause a break in the capital chain and create crisis in the industry.

Although China will overtake the US as the largest express delivery country, it is a late starter in the sector. In fact, the networks of most domestic express enterprises are not yet complete, and their employees are mainly men with relatively low education levels. And since the industry is still under construction, even senior workers are drawn to it just because of the salary and seldom have a sense of belonging.

The story is different in the US, where managerial-level employees in courier companies ensure that high-quality employees are recruited to help provide better services for customers. Take the FedEx as an example. It was founded in 1971, and within 40 years became a Fortune Global 500 company. It employs about 160,000 people worldwide, and uses 634 airplanes and 47,000 special freight cars to deliver letters and packages. FedEx also has won the World Best Employer award for providing both advantageous salaries and good corporate culture for its employees. Like many Western companies that strike a balance between service and profits, FedEx also believes that highly educated employees contribute to the company's better development.

In contrast, domestic companies seem to pay more attention to "profits", which is likely to lead them to a development path where service and precision could take a back seat. Of course, few foreign express delivery companies can compete with their domestic counterparts when it comes to providing services within the country. But that is because domestic companies charge must lower rates and foreign companies, with their stronger capital reserves, focus on international deliveries. Therefore, China's express industry must work out a strategy for better, rather than faster, development.

First, the managements of domestic companies should make serious efforts to increase customers' satisfaction. The managements have to keep pace with the feverish speed at which the express delivery industry is expanding, or else customers' dissatisfaction levels will increase, eventually leading to a crisis.

Second, Chinese companies, apart from recruiting quality employees, should make arrangements for staff training to make existing employees more efficient in order to win over potential customers.

Third, express delivery companies should run programs to instill a sense of belonging among employees and expand their "profit-only" motive to include "people and services". Only when employees have a sense of belonging will they take on extra responsibility and help the entire industry to grow healthily as well as profitably.

Fourth, express delivery companies need to share more social responsibilities. Since the express delivery industry greatly depends on the transportation sector, it needs to pay attention to environmental protection and use eco-friendly methods to deliver packages.

And last, domestic courier companies need to reach some sort of agreement to avoid harmful competition in the industry.

The author is a senior analyst of Sootoo Research Institute.