Solar products heat up dispute

The punitive tariffs imposed by the European Union on China-made solar products reflect the bloc's inherent defects and puts in doubt its intention to embrace sustainable development.

Judging from the chaotic situation in the EU, it is hard to fathom the intention of its anti-dumping and anti-subsidy investigations into Chinese solar panels. Is it to provide its low-efficient solar industry with the umbrella of trade protectionism? Or, is it meant to pressure China into making concessions on other fronts?

Some people speculate that the action is meant to force China into lowering tariffs on the luxury goods and agricultural products it imports from the EU. But such speculation doesn't make much sense.

Given that the EU has a significant trade deficit with China, it should try to capitalize on its large industries that enjoy a comparative advantage over China, instead of using its agricultural and luxury goods to boost its exports to China and revitalize the bloc's economy.

Of the $212.06 billion worth of goods that China imported from the EU last year, agricultural products accounted for only about $6.55 billion, or about 3 percent of the total. The percentage of luxury goods in the total imports, too, was small. So can an increase in the export of just agricultural and luxury products to China revitalize the EU economy?

The EU's probe into Chinese solar products involves 21 billion euros ($27 billion), making it the largest anti-dumping case of its kind. This will have an impact on tens of thousands of jobs in China. And if the EU makes the punitive tariffs permanent, it will hurt China-EU trade and political ties. Since the case is serious, the EU should have made coordinated efforts and sought the opinions of all its member states before ordering the investigation.

In fact, the majority of EU member states did not support the decision initiated by the European Commission, which shows that the investigation is not in the interest of the EU as a whole and is bound to be the cause of further trouble.

Countries like the United Kingdom, Germany and the Netherlands publicly rejected the punitive tariffs on Chinese solar panels. German Chancellor Angela Merkel even told journalists that Germany would make every effort to prevent the EU from imposing tariffs on Chinese solar product companies and forestall a China-EU trade war. Only France, Italy, Lithuania and Portugal supported the EC's decision to launch a probe while 18, or two-thirds, of the EU member states opposed it.

But EU Trade Commissioner Karel de Gucht attributed the voting result to pressure from China and imposed tariffs on Chinese solar panels for six months until December. The EU member states will vote again in December to decide whether the tariffs should be made permanent.

The Chinese solar industry has taken up more than 60 percent of the world's market share in just five years. The growth in China's solar industry is the result of efficiency and high productivity. But now the EU action threatens to derail this growth, which will ultimately also harm the bloc's solar industry.

The EU tends to resolve its sovereign debt crisis by resorting to trade protectionism on the pretext that its trading partners are employing unfair practices, because it knows that the domestic reforms it has planned will be painful enough for the people to lose trust in the member states' governments.

Perhaps launching retaliatory trade investigations is the best way China can hit back at the EU. But China's response to the EU's anti-dumping tariffs should not necessarily be through anti-dumping and anti-subsidy investigations to restrict EU exports to China. Since the EU economy is trapped in the debt crisis, and depends a lot on Chinese investments and exports to China, the government, for example, could curb these investments or cancel some trade orders. Or, it could take counter-action against France, Italy, Lithuania and Portugal, which supported the EC's decision to impose punitive tariffs on Chinese solar panels.

But retaliatory measures alone cannot help China's solar industry weather the imminent storm. The government also needs to make more efforts in some other areas.

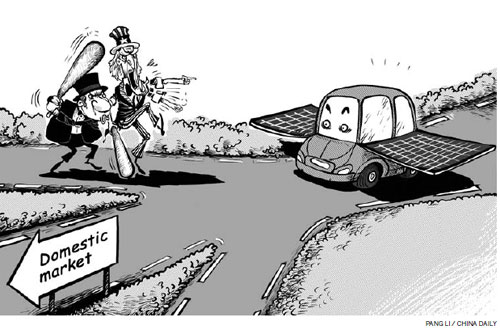

One of the major tasks of the government should be to take measures to expand the domestic market. More demand for solar products at home will offset the impact of the anti-dumping and anti-subsidy tariffs on Chinese companies.

China has the capability and resources to achieve its goal of installing facilities to generate an additional 10 GW of solar power and reach its target of 22-25 GW during the 12th Five-Year Plan period (2011-15). And since the demand for Chinese solar cells has increased because of a decline in prices, China should go ahead with its solar power plan.

Also, China needs to explore markets beyond the US and the EU and cash in on the increase in demand for solar products in the emerging economies. And it should devise a sound "going-out" strategy to finance and build solar power stations overseas to promote Chinese solar products. Some companies have already shown how this can be done profitably.

China's solar industry has succeeded because it depends on low costs and high efficiency. That's why it has thrived even amid falling fossil fuel prices. In contrast, dropping fossil fuel prices have hurt the prospects of US and EU solar panel companies because their costs are high and efficiency low. So even if the EU makes the punitive tariffs permanent, its solar products' companies will not be able to compete with their Chinese counterparts.

The author is a researcher at the Chinese Academy of International Trade and Economic Cooperation, affiliated to the Ministry of Commerce.

(China Daily 06/25/2013 page9)