Demand for gold at record high in Q1

China's gold demand jumped to a record high in the first quarter despite a global drop of 13 percent, according to a report released by the World Gold Council on Thursday.

Gold jewelry demand in China surged to a record quarterly value of 60.3 billion yuan ($9.8 billion), the council said.

Traditional Spring Festival-related gold buying and gifting was augmented by a rebound in sentiment regarding the strength of the domestic economy.

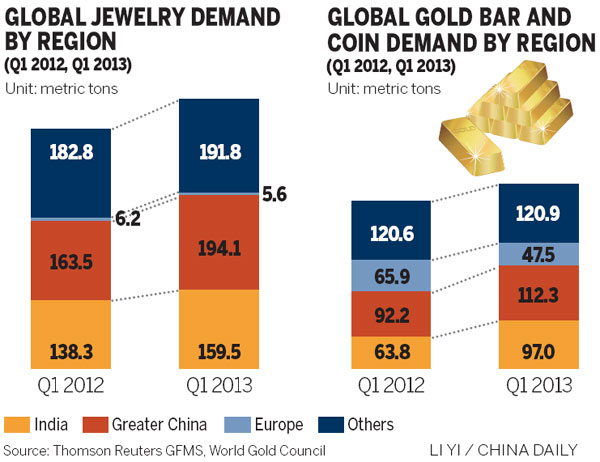

China and India accounted for a combined 62 percent of global jewelry demand in the first quarter.

China posted a new record for quarterly investment in gold bars and coins as positive seasonal factors worked in tandem with gold's enduring investment appeal. Demand grew to 109.5 metric tons, compared with a five-year quarterly average of 43.8 tons.

The Spring Festival period fueled buying in January, but demand was supported throughout the rest of the quarter as Chinese investors, discouraged by the weak domestic stock market, increasingly relied on gold to fulfill their investment needs.

The announcement in February of impending controls to be placed on the property market placed further emphasis on gold as an investment option.

Retail investors in China, India and the United States were at the forefront of investment demand in the first quarter, as evidenced by the strong rise in demand for gold bars and coins in those markets.

Global gold demand in the first quarter totaled 963 tons, decreasing 13 percent year-on-year as strong growth in consumer demand for gold jewelry, bars and coins was exceeded by substantial net outflows from gold exchange-traded funds.

"ETF data in the first quarter cannot reflect the true trading because gold can be borrowed," Hong Hao, managing director and chief strategist at BOCOM International Holdings Co Ltd, told China Daily.

The report also said the net result was an outflow of 176.9 tons from gold ETFs. However, it represented a decline of just 7 percent in total gold ETF holdings over the period.

Hong said the gold price declined due to factors including global deflationary pressure, investor George Soros' operations and a rally in the US dollar.

According to Hong, central banks in China, Germany, Switzerland and France will continue to buy gold.

Central banks added 109.2 tons of gold to their reserves in the first quarter, the ninth consecutive quarterly net purchase.

"Although within four to eight weeks, the gold price may continue to fall, it's a good time for long-term investors to buy gold because it will be of great potential in the long term," said Hong.

Marcus Grubb, a managing director at the World Gold Council, said: "The price drop in April proved to be the catalyst for a surge of buying that has left many retailers short of stock and refineries introducing waiting lists for deliveries. Putting this into context, sales of bars and coins, jewelry and consumption in the technology sector still make up 81 percent of the market.

"Overall, the long-term appetite for investment remains strong, demonstrated by the continued demand for bars and coins," Grubb said.

Gold dropped below $1,400 on Thursday, approaching prices not seen since its historic plunge a month ago.