Online shopping gaining popularity

Shopping in the fashionable stores of New York, London and Paris may soon be a thing of the past for Chinese customers, with online shopping fast changing the retail trade. Unlike popular Western shopping destinations, the online retail market is a new kid on the block. But more importantly, it is the impressive returns being notched up by the sector that are making it a "must-be" market for multinational companies and Western brands.

Up to now, the global retail market has often been dominated by mega brands with shops in prime locations. Shopping was often an experience that also had the added elements of affluence, travel and holiday built into it.

But all of that is slowly beginning to change as the prolonged financial problems in the Western markets have forced global retailers to increasingly look to China to bolster revenues even as the nation slowly makes a transition from "made in China" to "consumed in China".

The changing situation is clearly visible in the robust double-digit growth rates seen during the past few years. More importantly, in what is good news for the retail trade, the future looks bright for China, as demand is set to escalate further on the back of increased spending power and a growing number of affluent people in China.

The real catalyst for the retail boom in China has been the Internet, which has not only given a new meaning to online shopping but also opened up a plethora of opportunities for retailers in what is likely to be the biggest retail market in the world.

Smart move

The German auto major Daimler AG was one of the first big Western companies to realize the potential of online sales. The company's luxury car unit, Mercedes-Benz (China), has enjoyed considerable success with its ultra mini car, Smart, after using the online sales method.

Introduced in 2009, the Smart had sales of 11,000 units in China till February this year. The same month, the company teamed up with the Beijing-based Jingdong Mall, a leading business-to-customer platform, for online sales of Smart.

Since then, the Pearl Grey limited Smart edition, which costs 149,000 yuan ($23,661), has been in the shopping carts of more than 17,200 registered users of Jingdong Mall and enjoyed an online traffic volume of more than 2.27 million hits. Not surprisingly on the first day itself, Mercedes-Benz received booking for all the 300 Smarts it offered online in the first 89 minutes.

Big numbers

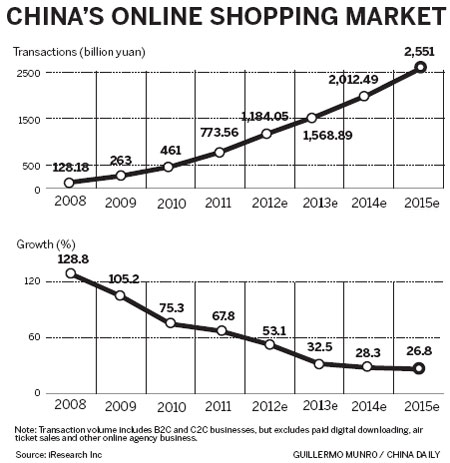

It is these kind of massive numbers that is making online shopping in China a phenomenon that cannot be ignored. The total e-commerce market in China reached $1.1 trillion in 2011, up about 46 percent from a year earlier, according to the market research firm iResearch.

It also shows that the total online shopping revenue in China for 2011 was 773.56 billion yuan, while in 2010 it was about 461 billion yuan. The online shopping revenue is expected to grow more than 50 percent to 1.18 trillion yuan this year and reach 2.55 trillion yuan by 2015.

According to the consultancy firm Boston Consulting Group, the share of e-commerce in total retail trade is expected to reach 7.4 percent in China by 2015 from the present 3.3 percent. That indeed is impressive growth, considering that it took a nation such as the United States nearly 10 years to achieve similar results.

China is also expected to surpass the US to become the largest e-commerce market in the world by then, achieving a compound annual growth rate of 33 percent, and a market size of more than 2 trillion yuan.

Perfect fit

Even as Western retailers are fast realizing the massive online retail opportunities that exist in China, it is apparel brands that have been the fastest off the block.

Though many of the big brands are striking it out on their own in the virtual world, others have realized that it pays dividends to team up with a local partner in an otherwise fiercely competitive market.

According to a recent survey by the global consultancy PricewaterhouseCoopers, nearly 60 percent of the online shoppers in China search and purchase clothing and footwear online, compared to just 23 percent of shoppers in the Netherlands.

The US clothing and accessories retailer GAP entered the Chinese market in 2010 at a time when similar companies such as Zara and Uniqlo already had more than 75 boutiques in China. The US retailer realized that if it had to make a mark in China, it needed to explore alternative channels like the online shopping business to shore up revenues. GAP has its own official e-commerce website as well as a flagship store on Tmall, the B2C arm of Alibaba Group.

The online shopping trend is not just restricted to mass market shopping, but also extends to luxury goods, the fastest growing segment. However, the online market still continues to be dominated by shoppers looking for premium, affordable products at the cheapest prices.

"The digitally-enabled environment is fast changing consumer shopping habits. The Internet will continue to increase in importance globally and in China, as both a marketing communication vehicle and a sales driver," says Jonathan Seliger, president and CEO of Coach China, a unit of Coach, a leading American designer and maker of luxury lifestyle handbags and accessories.

Rising costs

Though the growing number of shoppers has spurred online shopping in China, it has also been aided by the rising costs of setting up physical stores.

With the largest Internet population in the world, China also has the largest population of online shoppers - 195 million, far more than the 121 million in the US and 53 million in Japan, according to a report published by Data Driven Marketing Asia, a China-based market research company.

Chinese consumers spent $125 billion online in 2011, making China the third largest online market in online spends by consumers. The European Union is the largest market with $263 billion, followed by the US with $202 billion, data from DDMA show.

Information provided by PwC shows that Chinese consumers shop online nearly 8.4 times every month, nearly four times more than their European counterparts, 5.2 times more than in the US and 4.3 times in the UK.

What really is more enticing to companies is that the Chinese shopping spree is not restricted to Beijing, Shanghai and Guangzhou, but is helped largely by shoppers in cities as far-flung as Wuhan or Chengdu.

"From our research, we found that the increasing spending on online shopping is not restricted just to established cities but also encompasses developing cities," says Sam Mulligan, founder and director of DDMA.

"It is the new consumers from the smaller cities who are really fueling the trend as many of the brands are yet to establish a physical presence, whereas online shopping offers more choices and brands. Customers have money to spend and they are online most of the time and this will drive the retail trade."

"The rising rental and labor costs have also made the traditional retail channels expensive for many multinational companies in China," Mulligan says.

Retail rents in Shanghai and Beijing increased by 9.5 percent and 13.5 percent respectively in 2011, according to DDMA statistics, which also adds that retail rents in tier-1 markets during 2012 are likely to see a 12 percent spike. Rents have also gone up in second- and third-tier cities, though not as much as that in the biggest cities.

High stakes

With the winds clearly blowing toward the online market, the competition is also getting fiercer as more companies are vying for a slice of the pie.

Besides online retail pioneers such as Amazon China and Carrefour, which started their online business in 2004 and 2006 respectively, other multinational companies such as Tesco, Walmart and Metro China are also making rapid retail strides.

Carrefour established its own B2C platform but only provides services to Beijing and Shanghai shoppers. Tesco has only deals for clothing and baby products online, and all of those deals are operated by its flagship store on Tmall.

The US-based retailer Walmart has also been on an expansion spree in China and is fast sprucing up its online moves to tackle its competition.

Last year, Sam's Club, a retail warehouse club owned and operated by Walmart, launched its online operations. The online shopping service is available to Sam's Club members in Beijing and Shenzhen. In February, Walmart also increased its investment in Yihaodian, an online grocery store in Shanghai.

With 5,400 employees and a logistics network based in Shanghai, Beijing and Guangzhou, Yihaodian's revenue has grown from $127 million in 2010 to $430 million in 2011. The company now holds an estimated 2 percent share of the total Chinese B2C market, according to a DDMA report, citing sources from the Deloitte Fast 500 Asia Pacific 2011 report.

Difficult task

Though opportunities are plentiful, the difficulties are also formidable, experts say.

"Compared to multinational companies, local e-commerce companies enjoy more advantages," said Chen Shousong, a senior e-commerce analyst from Analysys International.

Chen says that multinational companies may not invest too much, until they are familiar with the market. On the other hand, local companies are more aggressive and enjoy considerable support from venture capital and private equity firms.

"Compared to traditional offline retailers, Internet companies are more fast-paced, have shorter product life cycle, and can be easily copied and replaced. It requires companies to develop products that cater to local demand quickly. Multinational companies cannot maintain this pace due to high communication costs and the structure of operations," Chen said.

Unlike its ambitious parent, which operates in diversified segments including B2C, Kindle device sales and platform services, Amazon China's development has been mainly in B2C. However, even after nearly eight years of expansion and development, Amazon China still lags behind Tmall and Jingdong Mall in market share.

Waldemar Jap, partner and managing director of BCG Great China attributes this to the different philosophy of the US retailer.

"China is a large market. Starting businesses in new cities does not mean adding new choices on your website. You need to be prepared in terms of services, supply chain and infrastructure," says Jap. "Some companies prefer to occupy the market even before they are ready, while some prefer to wait."

Lu Zhenwang, an independent e-commerce observer, said the e-commerce industry in China is not that favorable for multinational companies given that most of their Chinese competitors are gaining market share by losing huge amount of money every year.

"Take Jingdong Mall for example. If the turnover of Jingdong in 2011 was 30 billion yuan, and 2012 is 50 billion yuan, the total loss will be more than 4 billion yuan," Lu says. "From Amazon's perspective, it is hard to imagine how it is going to succeed."

Shipping concerns

Another challenge for e-commerce is logistics management to ensure product quality and delivery efficiency.

According to BCG's report, the e-commerce industry in China has benefited from low shipping costs of just $1 on average to ship a 1-kg parcel, compared with $6 in the US. However, logistics have also become one of the biggest concerns for online retail companies.

Due to the high cost of building their own delivery networks, many companies have outsourced these services to third-party logistics firms. But the negative feedback from many customers has promoted companies to set up their own delivery chains.

According to data provided by Jingdong Mall, the complaints on third-party delivery services are as high as 12 times that of what is recorded on their own delivery chain.

Amazon China is the first company to explore the possibility of having its own logistics network. In February, Amazon China announced the launch of its 11th fulfillment center in Tianjin, taking the total floor area of Amazon's fulfillment facilities in China close to 500,000 sq m.

"The fulfillment network is especially important in China given its vast territory," says Wang Hanhua, president of Amazon China. "Amazon is the earliest among e-commerce companies to invest in this area in China and is set to optimize its strategic layout in China on a long-term basis," he said.

However, distribution costs have increased by nearly 200 percent in the past five years. According to the China Federation of Logistics and Purchasing, logistics costs were the equivalent of 18 percent of GDP in 2011.

Warehousing costs are also increasing. The China Federation of Logistics and Purchasing stated that storage costs rose 22.6 percent year-on-year to 2.9 trillion yuan while management fees amounted to 1 trillion yuan, up 18.7 percent.

Another challenge, especially for offline retailers, lies in the integration of online and offline resources.

Chee Wee Gan, a principal in A.T. Kearney's Management Consulting practice in Shanghai, says that for traditional retailers such as Walmart, they already have certain advantages: they are typically very strong in merchandising, category management, product assortment, as well as having strong retailing experience.

"They can be powerful if they can successfully integrate their online and offline approach," Gan says. "But it will not be easy for them to do so."

He said that returning goods and managing fulfillment is still a big obstacle for online-offline synergy.

However, Gan said the multiple online channels act in diverse ways for retailers.

Most of the new online consumers tend to shop on the Taobao platform, whereas customers who are over one year old use the same platform only 50 percent of the time. In contrast, older or repeat customers spend less than a third of their time on Taobao shopping, Gan says.

"That means companies can use different channels to capture consumer trends. They can use Taobao to gain feedback from new consumers, and use more experienced consultancies to gauge consumer trends of older and experienced online shoppers."

Jap said companies must speed up their movements in the online sector, as it not only generates more sales, but also influences customer behavior.

"It is fine for some companies to prioritize their offline channels. But they still need to understand how the Internet is affecting the decision-making process," he said.

"Consumers may purchase products offline, but their research and decision-making process in the first-phase is greatly influenced by online information. This is especially so when buying items like large furniture. They will compare a lot of information before actually walking into an offline store."

Helping hand

The Ministry of Industry and Information Technology has issued an e-commerce 12th Five-Year Plan (2011-15) that aims to double the value of its e-commerce sales to 18 trillion yuan by the end of 2015. The online retail transaction by then is expected to exceed 3 trillion yuan and account for more than 9 percent of the total retail sales.

The government will intensify policy support and come out with the relevant regulations and policies for e-commerce development, Deputy Minister of Commerce Jiang Zengwei said at the recent national e-commerce work conference in Shenzhen.

Gan feels that while the future is indeed bright for e-commerce in China, there is going to be "more of a winner takes more type of situation", meaning that the leader will always get the bigger market share.

"There is a projection that by 2016, 16 percent of the retail trade in China will be conducted online, much higher than the US, where it is just 12 percent," he says.

But the physical retail landscape in China is nowhere as developed as those in the US or Japan. The Chinese online market is heavily fragmented, with consumers leapfrogging from various sites to grab elusive bargains.

"The e-commerce battle will not be fought in first-tier cities such as Beijing, Shanghai or Guangzhou. The real battle will be in second- and third-tier cities, where new middle class consumers are coming up. It is not going to be that easy for companies to expand their physical presence in these locations. Going online is the best way to ensure that they get more consumers and profits," Gan says.

Contact the writers at linjingcd@chinadaily.com.cn and suzhou@chinadaily.com.cn