Most of China's major listed automakers reported profits in the first half of the year, as the country's automobile market went back to double-digit growth after it stagnated in the last two years.

As of Saturday, 80 listed automakers had filed their first-half financial reports to the Shanghai and Shenzhen stock exchanges, with 55 of them reporting increases in revenue.

The Shenzhen-based battery and car maker BYD Co Ltd led the list after its net profit increased a staggering 25.24 times to 427 million yuan ($69.76 million) in the first half. The company's net profit slumped 94.15 percent year-on-year to 81 million yuan in 2012, the lowest level in at least four years.

The Warren Buffett-backed company attributed the surging growth to the recovery in all of its three major business areas: vehicles, cell phones and new energy, according to its financial report filed with the Shenzhen Stock Exchange.

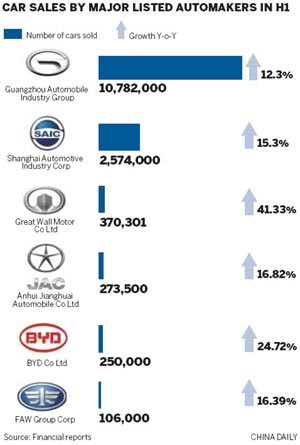

It sold about 250,000 vehicles in China in the first half, up 24.72 percent year-on-year, and double the domestic market's year-on-year growth rate of 12.3 percent.

FAW Car Co Ltd followed BYD as it reported a 1,120 percent increase in net profit in the first half. The astonishing growth, representing a 627 million yuan profit, was based on the company's 15.66 percent year-on-year increase in vehicle sales.

"The launch of new models, like the Hongqi H7 and Besturn X80, greatly improved our vehicle sales in the period. And the yuan appreciation also helped to lower the costs of imported parts, which was another factor behind the surge in profits," said the company in a statement filed with the Shenzhen Stock exchange.

The Haikou-based Haima Automobile Group Co Ltd ranked third as its net profit skyrocketed 106 percent to 121 million yuan in the first half.

The company said in a statement filed with the Shenzhen Stock Exchange that the profit increase was the result of new product launches, especially sport utility vehicles.

Meanwhile, Shanghai-listed companies Great Wall Motor Co Ltd, JAC Motors Co Ltd, Jinbei Auto Co Ltd, and Shenzhen-listed Zhongtong Bus Co Ltd and Ankai Bus Co Ltd all said that their net profit jumped by more than 50 percent in the first six months, as vehicle sales were driven by increasing demand.

"We didn't expect most of the listed automakers to report such high profit increases in the first half. The main reason was definitely the unpredicted and rapidly warming trend of China's automobile market," said Chang Lu, an auto analyst with Shenyin & Wanguo Securities.

In the first half, total vehicle sales in China - the world's largest automobile market - increased 12.34 percent, higher than the industry observers' estimates of a figure below 10 percent.