Honeywell International Inc decided in June to move its Beijing office from a building in Liangmaqiao, a busy street in the eastern part of the city that runs off the Third Ring Road, to Jiuxianqiao, near the northeastern Fifth Ring Road.

The relocation will allow the multinational corporation to consolidate all its Beijing employees at one location in a new office building with nearly 15,000 square meters of space. It also brings the technology company near other industry giants.

What's more, the rent in Jiuxianqiao will be about half as much as in Liangmaqiao, which is near many high-end hotels, apartment buildings and embassies.

A Honeywell manager said the relocation will begin in the second half of this year. The company hopes that the consolidation will improve working efficiency.

Honeywell isn't alone in making this type of decision. In the past few years, driven by ever-rising downtown rents, more multinationals in China have moved their Beijing or Shanghai offices to cheaper locations. Many more are considering such moves.

Some companies made that decision years ago, such as Motorola Inc and IBM Corp, which shifted their offices before the 2008 financial crisis.

But now, so many multinationals are following this path that real estate consultants Cushman & Wakefield said in a recent report that it's become a trend.

Cost is a major concern, of course. According to C&W's data, as of the second quarter of 2013, office rents had increased 43 percent in Shanghai and an astonishing 138 percent in Beijing compared with 2009.

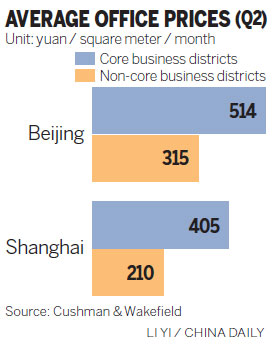

Grade-A office buildings in Beijing's non-core areas are 30 percent cheaper than similar buildings in core areas. In Shanghai, the difference is almost 50 percent.

In some cases, cost isn't the only issue. Beijing's and Shanghai's central business districts are increasingly crowded and there are few available offices left.

For example, in Beijing, the core-submarket vacancy rate declined from 20.7 percent at the end of 2009 to just 4.2 percent in the second quarter of this year. This means that even if multinationals are willing to pay the high rents in core areas, they may find it difficult to get extra space.