BOAO -- Chinese firms are venturing overseas to tap the global market, but many feel shackled due to cultural and financing difficulties, analysts said at an ongoing international forum.

With the government wanting the market to play a decisive role in allocating resources, it means fiercer competition for Chinese firms and will lead them to seek overseas resources, said Liu Chuanzhi, chairman of Lenovo Holdings, at the ongoing Boao Forum for Asia (BFA) 2014 Annual Conference.

He and fellow delegates were speaking during a discussion on Chinese firms going global at the forum on Wednesday evening.

Since China's reform and opening-up in the late 1970s, Chinese accumulated overseas investment topped $600 billion by the end of 2013, with new investment worth $104.5 billion alone last year, according to Zhang Guobao, president of

|

|

|

|

Chinese firms are increasingly trying to become major global players by acquiring their more renowned foreign peers.

Chinese IT company Lenovo acquired IBM's PC division in 2005, bringing more brand recognition to Lenovo and an increased market share both at home and abroad.

"The acquisition was not easy. It took a lot of work in market research, corporate cultural integration and adjustment of the management team and strategies," said Liu.

However, Lenovo is only one of a few to survive and thrive after a merger and acquisition (M&A).

There were 99 successful overseas M&A deals made by Chinese companies last year.

About 70 percent of Chinese firms' overseas M&A efforts have failed mostly due to cultural integration problems or legal barriers, said Ma Weihua, chairman of Wing Lung Bank Ltd., and former president and CEO of China Merchants Bank (CMB).

The integration of rigid western KPI (key performance indicators)management system with flexible and human-oriented Chinese business culture is key for new mergers, Liu said.

But for Ma, the biggest headache for Chinese companies in their global push is multi-tier financing difficulties.

Chinese firms cannot take domestic loans abroad to support business overseas, and private enterprises feel they are being disadvantaged as they lack the support that their state-owned counterparts may enjoy from policy banks.

Besides, they face a credit guarantee cap of $20 million, anything higher needs to be approved by the Ministry of Finance, Ma added.

Foreign financial institutions also feel reluctant to lend money to cash-strapped Chinese firms for most new entrants in the market are burdened with heavy debt while only making a marginal profit in the early stages.

Meanwhile, they have few Chinese banks to turn to for help as Chinese financial institutions are also struggling to establish their foothold in overseas markets due to rigid local financial regulations.

CMB opened its New York branch in 2008 after ten years' preparation and negotiation, marking the first operational certificate issued to Chinese banks within 17 years since the U.S. implementation of the Foreign Bank Supervision Enhancement Act of 1991.

The government should give Chinese firms a leg up in their going global ventures, such as offering them overseas loans with national foreign exchange deposits, Ma said.

Higher and wider credit guarantee services and fewer government administrative approvals may also help, he added.

|

|

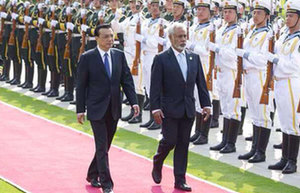

| Premier Li meets with Namibia's PM |