US law firm sees Chinese M&A abroad rebounding on B&R

A rebound in Chinese companies' overseas mergers and acquisitions is on the horizon, thanks to the implementation of the Belt and Road Initiative, according to Baker McKenzie, a Chicago-based multinational law firm.

Cross-border M&As by Chinese companies had slowed during the first half of this year due to regulatory tightening.

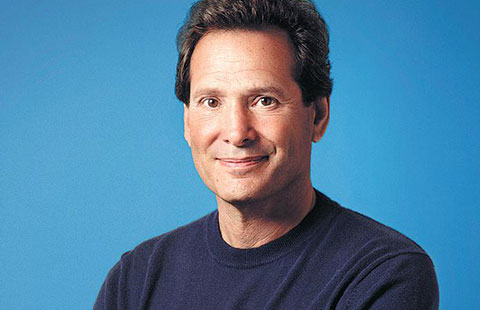

Paul Rawlinson, global chair, Baker McKenzie, who is on a visit to Beijing, said on Wednesday, "We are quite confident that despite the short-term financial constraints on doing deals, the underlying drivers for doing deals and business opportunities are real, and we are already starting to see a pickup in M&A activity."

Baker McKenzie and Oxford Economics, a global advisory firm, analyzed trends across sectors and markets and predicted that global M&As will rise to $3 trillion in 2018, up from an estimated $2.6 trillion this year.

That rise will likely come from an expected rebound in overseas M&As by companies in the Chinese mainland and Hong Kong, Rawlinson said.

In August, Beijing tightened norms for Chinese outbound direct investment or ODI, following a rapid decline in foreign exchange reserves last year.

The government restricted Chinese companies' ODI in certain sectors, including real estate, hotels, entertainment and sports clubs.

Projects that do not meet the host country's standards for environmental protection, energy consumption and safety were also included in the list.

"Such a policy clearly has a certain negative impact on outbound investment, particularly in certain sectors. But we do believe such impact is short term and the policy actually helps Chinese companies to implement their outbound investment strategy on a sustainable and long-term basis," said Stanley Jia, chief representative of Baker McKenzie's Beijing office.

"Over the last year or so, the Belt and Road Initiative has become a dominant driving force behind China's outbound investment," Jia said.

Proposed by President Xi Jinping in 2013, the B&R Initiative aims to set up or strengthen connectivity among Asia, Europe, Africa and their adjacent seas through massive transport and communication links, to boost business, trade, infrastructure and economic partnerships.

Rawlinson said lawyers at Baker McKenzie have seen a lot of Chinese companies actively developing B&R projects-mostly infrastructure in the power sector and high-speed railways in some key countries and regions participating in the initiative.

Ministry of Commerce data show new investments by Chinese companies in 47 economies related to the B&R Initiative increased by 6 percentage points year-on-year to $6.61 billion in the first half of this year, while China's non-financial ODI fell almost 46 percent to $48.19 billion.

Qian Keming, China's vice-minister of commerce, said at a news conference in July: "Irrational outbound investment has been effectively curbed."

An increasing number of Chinese companies are paying closer attention to post-M&A operational risks, to mitigate legal risks and to protect their investments, Jia said.

Based on its long-term strategy, Baker McKenzie has identified China as one of its three key markets, along with London and New York.

Baker McKenzie's China operations are mainly centered on Beijing and Shanghai.

In 2015, it became the first international law firm to acquire a license to run a joint operation office in the Shanghai free trade zone.