New rule on ODI is in the pipeline

Regulation will draw a clear line on areas to be encouraged, forbidden

China plans to introduce its first regulation on making outbound direct investments later this year to clarify and define the range of overseas investments, as well as listing prohibited areas and other essential factors, according to a report by Beijing-based newspaper the Economic Information Daily on Tuesday.The Ministry of Commerce and the National Development and Reform Commission, the country's top economic watchdogs, are leading the work to draft the regulation, the newspaper that is affiliated with Xinhua News Agency quoted an insider as saying.

The new rule will map out an overall structure governing outbound investments from the State level, combining and making further clarification of current rules in areas such as review procedures, tax policies and allowed amount for capital flows. It will also draw a clear line on the areas to be encouraged and forbidden, according to the report.

The Commerce Ministry and the NDRC declined to confirm the report on Tuesday.

He Jingtong, a business professor at Nankai University in Tianjin, said: "The rule will hold back some domestic companies making overseas acquisitions under heavy debt. The authorities will elevate the review requirements to ensure that the deals are authentic."

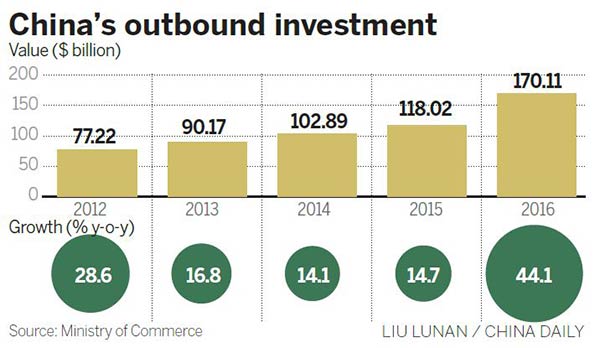

China's outbound direct investments have rocketed faster than the growth pace of foreign direct investment.

China's non-financial ODI soared 44.1 percent year-on-year to $170 billion in 2016, data from the Ministry of Commerce showed.

Zhou Liujun, director-general of the department of outward investment and economic cooperation at the ministry, said earlier in March: "The government will encourage ODI activities that can assist the development of the Belt and Road Initiative and resolve the issue of overcapacity in global markets, as well as supervising and preventing irrational investments."

Despite rapid ODI growth in 2016, Chinese companies confront growing risks in investing overseas due to fluctuations on international financial markets, economic uncertainties in other countries and restrictions by some developed nations on investment from China, particularly from State-owned enterprises.

He Jingtong said: "China is in urgent need of regulations that can lead the investment trend, and the country needs a reform of the investment system, to create better conditions and a safe legal environment for Chinese companies to invest abroad."

Liang Guoyong, an economic affairs official at the UN Conference on Trade and Development, said: "With China's cumulative ODI soaring to $1 trillion in 2015, China is now a net capital exporter and the second-largest country in conducting ODI activities. With the implementation of the Belt and Road Initiative, an adequate and prompt regulation is fairly necessary."