Optimism about growth and profitability in China among companies from the European Union has dropped to a record low, with an increasing number planning to cut jobs in the nation, a survey by the European Union Chamber of Commerce in China showed on Wednesday.

The survey found that 39 percent of EU-based companies-a record high-plan to cut costs in China this year, mostly by layoffs, compared with just 24 percent last year.

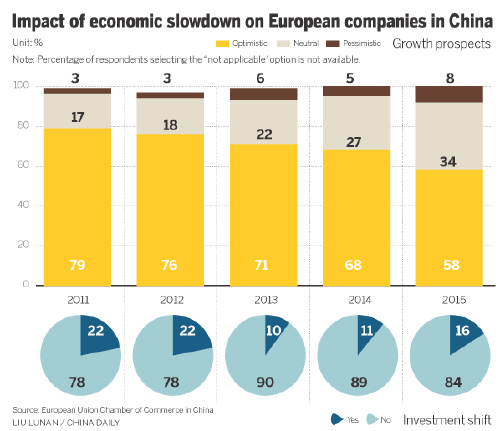

Nearly one-quarter of the companies are pessimistic about their profitability prospects in China, according to the survey. A majority (58 percent) of the respondents remained optimistic about growth outlook, but that figure still represented a 10-percentage-point drop from last year, and it was the lowest since 2011.

EU companies in industrial goods and services are the least optimistic and hardest-hit by the economic slowdown. Companies in the professional services and consumer goods/services segments have a brighter outlook.

One-third of EU-based businesses said they will put investment and expansion in China on hold.

China's position in the rankings as a target for investment has also declined. The proportion of EU companies that ranked China as the top investment target, or even put it among the top three, shrank to 59 percent in all, a 9-percentage-point drop from last year.

Rising labor costs, which did not even make the list of top 10 business challenges in China last year, was ranked second this year. The economic slowdown in China was ranked the top business challenge in the survey.

"Companies are laying people off and engaging in cost reduction plans to make them slimmer and better able to tackle the difficult business environment," said Jorg Wuttke, president of the chamber.

Wuttke said that while EU companies are diversifying their investment to other markets, they remain committed to China as there is "no second China" in sight that could compare in terms of market scale and potential.

The survey was jointly conducted by the chamber and German consulting firm Roland Berger Strategy Consultants GmbH in February and March. They surveyed 541 EU companies.

About 60 percent of the respondents were small and medium-sized companies with fewer than 250 employees. The rest were large multinational corporations.

Weak sentiment among European investors sparked worries that their plans to scale back may put even more downward pressure on the Chinese economy, which is growing at the slowest rate in the past two decades.

Watson Liu, a senior partner at Roland Berger, said that the negative impact of European companies' job cuts might not be as serious as assumed, because the survey did not reflect some new investment trends taking place in the country.

"European companies may be scaling back investment on some traditional labor-intensive sectors, but they are boosting investment in new emerging sectors such as the advanced and intelligent manufacturing segment, especially after China announced the strategy of 'Made in China 2025' to upgrade the domestic manufacturing sector," Liu said.

The survey showed increasing demand by EU firms for greater market access, effective implementation of reforms and the rule of law and better protection of intellectual property rights.

Internet issues such as slow speeds and access restrictions were cited in the survey as impediments to productivity, data exchange, research and innovation of EU companies.