|

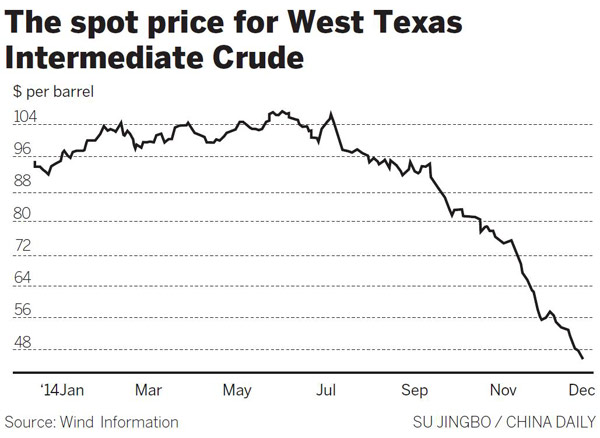

Editor's note: The global crude price drop started in June last year when the price was still above $100 per barrel. However, Chinese refineries have not seen any benefit from this decline because of weak downstream markets and high inventories that had to be sold at lower prices. |

|

Exploration losses loom for oil majors Industry experts are predicting losses in the upstream exploration activities of China's top three oil giants this year, as a result of the plunge in global oil prices. Li Yan, a researcher with domestic energy consultancy Shandong Longzhong Information Technology Co, thinks all three-China National Petroleum Corp, Sinopec Group and China National Offshore Oil Corp-are likely to have slipped into the red for the full-year 2014, after six months of falling crude prices since June. Read more>> |

|

|

|

Adapting to shrinking price |

|

ConocoPhillips Co: plans to cut capital expenditure by 20 percent to $13.5 billion, cut spending on upstream exploration by 23 percent to $5 billion in 2015 BP PLc: plans to cut capital expenditure by $1 billion to $2 billion in 2015 and cut thousands of jobs worldwide Petroleum Nasional Bhd (Malaysian state oil company): plans to cut capital expenditure by 15 percent to 20 percent in 2015 Continental Resources Inc: plans to cut capital expenditure by 11.5 percent to $4.6 billion in 2015 EOG Resources Inc: will divest oil and gas assets in Canada and reduce staff Exxon Mobil Corp: has said it can "survive the market" with an oil price as low as $40 a barrel Chevron Corp: said that declining oil prices "will not affect its investments in Mexico, and the company plans to increase the number of drilling wells in Argentina". China Petroleum& Chemical Corp (Sinopec): will maintain investment in shale gas drilling. - -Summarized from public information |

|

The spot pricce for West Texas Intermediate Crude |

|

|

|

Small refineries struggling to stay afloat Under pressure from a plunge in world oil prices that began in June, small local refineries that were already grappling with a glutted market have seen their profits almost evaporate, and some may even close, industry sources said. The price of one international trading benchmark, Brent crude oil, has declined by more than 55 percent in the past seven months to below $50 a barrel. |

|

Explorers look to the long term with shale gas With their eyes on long-term diversification of domestic energy supplies, Chinese oil giants will maintain their shale gas exploration drive this year even as global crude prices have tumbled. Affected by weakening demand from China, the world's second-largest oil consumer, and a glut in the global market, the spot price for West Texas Intermediate Crude plunged below $50 per barrel on Jan 5, the lowest since April 2009. |