|

|

|

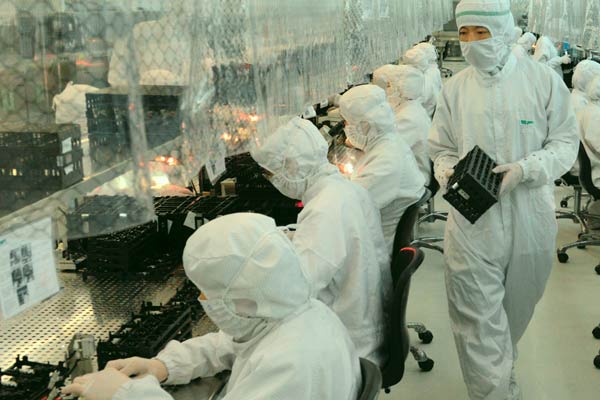

An electronics appliance company in Dongguan, Guangdong province. Lower seasonal demand from overseas buyers led to grim performances of small and medium-sized exporters in the first half of the year in the Pearl River Delta, one of the country's major manufacturing and trade hubs.CHINA DAILY |

Trade conditions for small and medium-sized exporters in the Pearl River Delta, one of the country's major manufacturing and trade hubs, were poor in the first half of the year due to lower seasonal demand, an industrial report said.

The Trade Climate Index, which reflects exporters' confidence in trade, stood at 99.06 in June, lower than the satisfaction threshold, indicating an unstable trend for exporters in the Delta region, according to a report released on Tuesday by trade service provider Shenzhen Onetouch Business Service Co, a subsidiary of Alibaba Group Holding Ltd, and based on a survey of 500 small and medium-sized companies.

"The grim performance was mainly due to lower seasonal demand from overseas buyers in May and June," said Xiao Feng, deputy general manager of Shenzhen Onetouch.

Meanwhile, the price of export commodities also declined significantly, with the price index reaching only 64.75 in June.

"The decline in prices indicated that value-added products were still in short demand from overseas buyers," Xiao told China Daily.

He Guodong, general manager of Shenzhen Xingjisheng Electronics Co, said the company had felt mounting pressure to make business profits as prices declined. He attributed the lower price to a fierce but disorderly industrial competition for Chinese products.

"For example, the price of similar products ranged from $2 to $200. Buyers would prefer to purchase products with a lower price," he said.

"Given such a situation, high-tech products, which are value-added, do not necessarily mean a high price, making it hard for producers to make profits."

However, Xiao predicted that trade in the region would pick up, with an upswing in the second half of the year, usually a peak period due to demand of Christmas-related products.

"The government should introduce more trade service for exporters as they are facing increased pressure to make profits due to lower price and rising production costs," Xiao said.

Guangdong's trade was down 16.7 percent year-on-year to 2.89 trillion yuan ($468.26 billion) in the first six months, accounting for 23.4 percent of the country's total, according to the provincial customs.

Specifically, Guangdong's export value in the first half of the year was 1.7 trillion yuan, down 14 percent from a year earlier.