|

| |

|

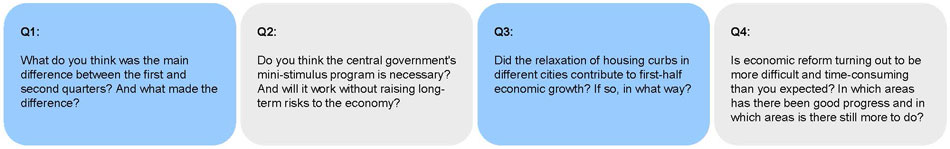

Ahead of the release on Wednesday of second-quarter GDP figures, China Daily asked several economists for their estimates. The difference between the lowest and highest figures was just 0.2 percentage point. It was not surprising that the economists all commented favorably on the country's efforts to sustain growth in the second quarter. From the central government's mini-stimulus, consisting mainly of fresh capital for infrastructure development, to the relaxation of housing curbs by some local governments - all drew positive responses. Reform is China's long-term goal. So far, China has been able to balance reform with short-term growth, although most economists warned that the reform drive has not yet proven powerful enough to overcome the resistance of vested interests. There is more work to do in the remainder of the year, they said. What are your estimates for China's GDP growth during the first half?

Estimated GDP growth rate during the first half: 7.3 percent | |

|

The risks accumulated in some fields like the housing market, finance industry and "shadow banks" have come close to a critical point. Lowering the reserve requirement ratio for certain banks will create stimulus. But it is not enough. The best stimulus is cutting taxes.

But the bailout's effects are as yet unclear. The market is still feeling negative about the future. The decline of the housing market will cast negative influences on the economy.

The prospect of reform is not optimistic. The slow reform in the China (Shanghai) Pilot Free Trade Zone, an experimental field for financial reform, is a case in point. Estimated GDP growth rate during the first half: 7.5 percent

----- Liu Shengjun Executive deputy director, CEIBS Lujiazui Institute of International Finance | |

|

For example, China nearly allowed a trust default in January before it decided to bail out the product at the last minute. A hawkish tone led to misunderstandings that China might sacrifice growth to achieve reform. This actually weighed on market sentiment, which led to a weak performance in the first quarter. However, from April onward, the government launched mini-stimulus policies, signaling that it's seeking a balance between growth and reform. The fine-tuning of the policy has revived confidence, as evidenced by the latest data.

Stable growth is a precondition for China to achieve the long-term goal of reform. There is nothing wrong with taking two steps forward and one step backward.

All property-related data continued to point toward the downside. In particular, property prices have started to fall since April. The impact of relaxation may only emerge in the second half should more cities announce more relaxation.

I think reform is an art, not a science. There is no fixed formula for it. As such, I am reluctant to predict how many years China still needs to accomplish its reform. It will really be growth-dependent. As I am based in Singapore, yuan internationalization is the key reform I can feel directly. The pace of yuan internationalization is amazing. We could barely do anything with the currency in the region five years ago. But now, the yuan is as important as the dollar in the region. ----- Xie Dongming Economist at Singapore-based Overseas-Chinese Banking Corp Ltd

| |

The dangerous tendency has started appearing and must be stopped. The mini-stimulus must be in line with restructuring efforts, industrial upgrading and a growth model shift. Its purpose is by no means to beef up economic growth. The central government should draw lessons from the 4 trillion yuan stimulus package of 2008. The mini-stimulus must be more flexible, well-targeted and efficient.

They are actually allocating limited financial resources to the wrong place. Once the bubble bursts, the consequences will be unimaginable.

The development of the China (Shanghai) Pilot Free Trade Zone is also bearing fruit. But the FTZ needs to do more. The most dangerous reform is financial reform. The most difficult reform is to redistribute income among different groups of people and the ending of State-owned enterprises' monopolies in the market. In fact, reforms have been carried out in all fields. But no palpable breakthroughs have yet been made. Estimated GDP growth rate during the first half: 7.4 percent

----- Chen Fengying Director of Institute of World Economic Studies, China Institutes of Contemporary International Relations | |

|

If the trend of the experts' assessments of the current business cycle in China and their estimates of economic development in the first quarter are compared with the respective values in the second quarter, it becomes apparent that assessments of the current situation plunged in March and gained momentum again only very recently in June. Economic expectations gradually deteriorated from very high levels in the first quarter to slightly positive values in the second quarter. From a sectoral perspective, decelerating output growth in the construction industry and signs of overcapacity in the housing market significantly contributed to this picture.

While the effects will have a time lag and will be relatively small in comparison with total GDP, the mini-stimulus program has sent a signal to market participants that the government is willing to stick to its official objective of 7.5 percent GDP growth in 2014. Further, the expectation of additional spending on energy and infrastructure projects, most notably in rural regions, has changed the momentum of the CEP analysts' sales expectations for important sectors such as electronics, machinery, construction and energy.

Beijing and Shanghai are currently the only cities for which a slight increase in prices is expected, while the experts assume price decreases in Hong Kong, Guangzhou, Shenzhen and Tianjin. This suggests that the housing market is currently in a condition that is very challenging for economic policy. Due to the considerable contribution of residential construction to growth, it can indeed be seen as a major risk factor for economic health in China. Any relaxation of price controls can help the market regain momentum, while housing affordability for low- and middle-income households must stay an important policy goal. Estimated GDP growth rate during the first half: 7.4 percent ----- Lerbs Oliver Economist at German Think Tank Zew (the Center for European Economic Research), Consultant with the Fudan Development Institute | |

|

Nothing much changed appreciably between the first and second quarters. Exports picked up a bit but domestic-related investment slowed because of the housing market. Cuts in banks' required reserve ratios and the mini-stimulus will push growth toward the government's target in the second half of 2014.

The housing market will remain a downward drag on growth for most of 2014.

Yes, it has been quite difficult. The main difficulty is the political area, because there are so many interests to consider. However I think the central leadership deserves credit for thinking big and for its willingness to keep pushing against these interests. Reforms have made steady progress in the financial area, with the China (Shanghai) Pilot Free Trade Zone, yuan band widening and so on being notable achievements. However, there are many areas still to reform. One thing is that the government is still not keen to allow trust products to default, so it bails them out at the last minute even though it repeatedly warns the public that it will allow them to fail. Estimated GDP growth rate during the first half: 7.4 percent ----- Alaistair Chan An economist at Moody's Analytics | |

|

Another major difference is that exports delivered a better performance while infrastructure investment ramped up. Exports in May posted a 7 percent jump and the growth in June hit 7.2 percent. Infrastructure investment growth also accelerated as the central government scaled up its mini-stimulus efforts.

In the down part of the cycle of a property market in which home prices dip, people choose to wait. They buy when prices climb. This is a common psychology. From the market perspective, the government should allow more Chinese cities to loosen their curbs, because these controls are an administrative method, which in itself undermines the decisive role of the market.

On the positive side, the government (in terms of the finance sector) has allowed wider daily fluctuation of the foreign exchange rate and moved further toward full interest rate liberalization. On the investment side, the government has tentatively introduced the "negative list" system, but the enforcement area is still confined. The government has also allowed 10 localities to issue bonds independently, but success requires more reforms, such as in local government public finance, to support that. ----- Li Miaoxian Macroeconomic analyst with BOCOM International Holdings Co Ltd |