Watchdog bites with no favor

|

|

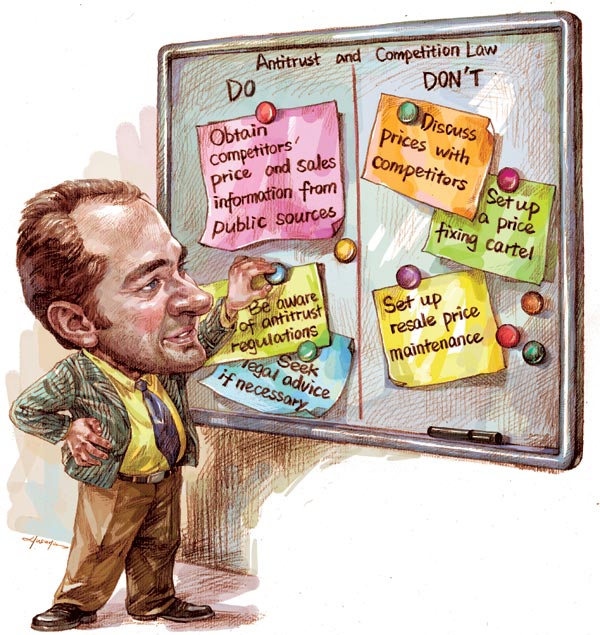

"Rather than the green part which lists the 'dos', it is the red 'don'ts' which is being increasingly 'discussed' now by officials," says a chamber official, adding that most of the participants in these discussions are representatives of baby formula and gold jewelry makers, and pharmaceutical and automobile companies.

Experts point out that recent inquiries have related to corruption and anti-competitive behavior such as price fixing, and there is little doubt that foreign companies have not been under so much pressure in China since competition laws came into effect five years ago.

"The concern is that even though China doesn't really have a plan to target foreign companies the outcome perception is also important the perception is sometimes as important as the reality," Cucino says.

Despite the concerns and the perceptions, most of the experts say the probes are not directed at multinationals, and signify stronger enforcement of antitrust and competition laws in China.

As China moves toward a more mature market-led economy, such investigations are bound to increase, they say, and better law enforcement will help foreign companies to better fix their strategies in China and create a healthy legal system.

Xiaowei Rose Luo, associate professor of entrepreneurship and family enterprise at Insead, one of the world's largest business schools, with campuses in Europe, Asia and the Middle East, says that despite the concerns, the recent investigations are a sign of the stronger enforcement of antitrust laws and deepening market transition in China.

"If you look at the ratio of international firms and domestic firms being investigated, you may get the impression that multinationals have a larger share," Luo says.

"Since the inquiries are a recent phenomenon and the enforcement is getting stronger, it is too early to use the ratio to make such conclusions. I would rather prefer to look at it more qualitatively. Some high-profile domestic jewelry and liquor firms have also been investigated and fined," says Luo, whose research has focused on how unique conditions in emerging economies can affect corporate strategies and performance.

In August, five foreign milk powder makers were fined $110 million (83 million euros) by the National Development and Reform Commission for violating contract laws with distributors and for ensuring minimum resale prices. In the same month, authorities imposed fines totaling 10.6 million yuan ($1.7 million; 1.3 million euros) on five local jewelry retailers for price manipulation. In February, Chinese premium liquor makers Kweichow Moutai Co Ltd and Wuliangye Yibin Co Ltd were fined 449 million yuan for setting minimum resale prices.

NDRC officials say investigations in other sectors are also underway, but refused to be more specific because of the complexity of enforcing anti-monopoly laws.

"Investigations against domestic companies seem to be on a much smaller scale when compared with foreign companies," Waterman of the US Chamber of Commerce says. "This is what we are watching closely. However, we also support China's right to have a strong antitrust regime, as we think it is the basis for modern market-based economies.

"The question now is whether the authorities will use the same yardstick for domestic and foreign companies. This is a big question and we don't know the answer. We have heard rumors that there may be some forthcoming enforcement actions against state-owned enterprises, but we haven't seen it yet."