Small not seen as so beautiful by banks

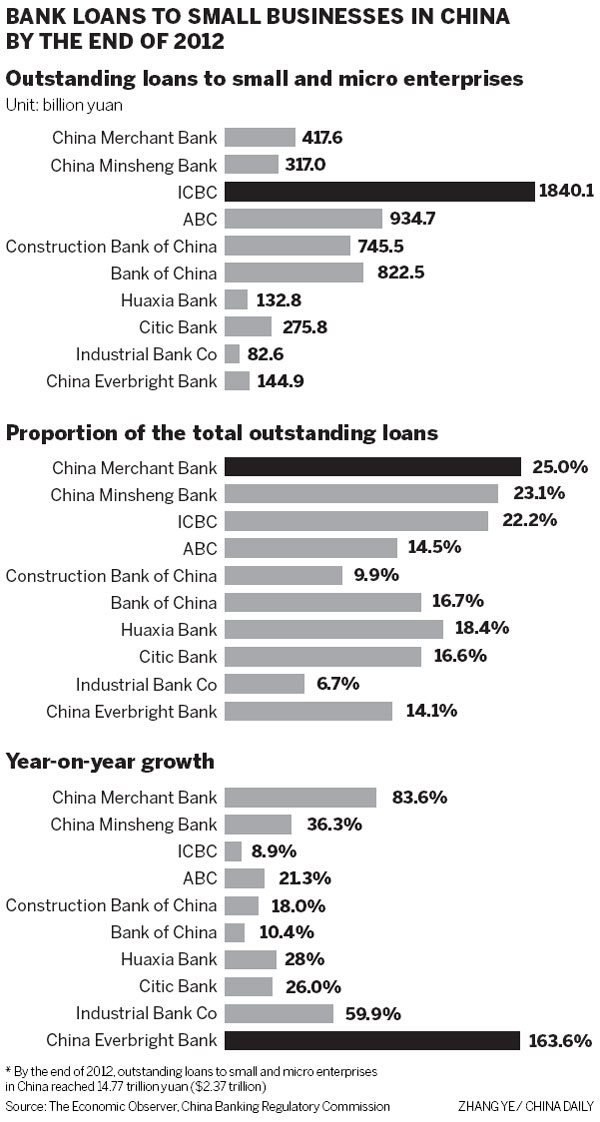

"This is a result of Minsheng's small and micro direction," Zhao Xin'an, an analyst with Northeast Securities, said. "Now it is taking the lead in this area and has many followers."

As a latecomer, Minsheng had fewer resources than other big State-owned banks. It chose to establish its strength in sectors closely related to people's livelihoods, such as tea, stones and fishing. It asked its local branches to transform themselves into expert lenders in specific local industries.

One of the classic example came in 2012 when Minsheng signed an agreement with Inner Mongolian Yili Industrial Group Co, the country's largest milk manufacturer, providing credit to its more than 100 suppliers and 540 distributors across China. As Yili owns detailed information of its suppliers and distributors, Minsheng could offer loans to them with interest rates just half those of ordinary loans.

Hardly felt gains

Contrary to Chinese bankers' enthusiasm and product innovations, China's small and micro enterprises still feel bank loans are a challenge for them.

Li Guoru, chairman of Dongguan Anwell Digital Machinery Co, said last month he heard that the banks had lowered their loan thresholds for small companies like his business. But a further inquiry disappointed him. Although the nominal cost of bank loans is not as high as small loans from other companies, the actual cost of a bank loan is higher if one takes into account the handling charges, guarantee fees and required deposit.

Li's experience is a common complaint among small and micro firms and was echoed in a study led by Ba of the Development Research Center under the State Council. The study, based on a survey of 1,000 small and micro enterprises across China, found that 31.8 percent of SMEs considered bank loans as the most expensive means of financing, compared with 27.1 percent for small loan companies.

Other difficulties reported by SMEs, according to the study, included long waiting periods for loans to arrive (45.8 percent), an inability to provide sufficient collateral or guarantees (41.1 percent) and an inability to provide professional financial statements (31.3 percent).

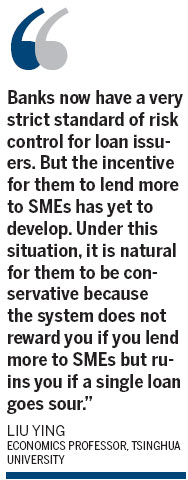

"In the conference (on service innovation for small and medium-sized enterprises), I heard people from the Agricultural Bank of China saying they issued around 40,000 loans last year. But considering ABC has about 20,000 branches across China and many of them are in the countryside, each branch actually only issued two loans annually," said Liu Ying, an economics professor at Tsinghua University who participated in the conference.

"How can you expect the formal-suited officers in these banks to deal with, say, a farmer who wants to borrow money to buy a new machine?" Wu asked.

Ba said SME loan requests were characterized by short lending terms, small amounts, high frequency and hasty needs. However, applying for a loan from banks is a long and complicated process, which puts off most SME owners who are in need of a quick loan.

In consequence, SMEs often seek financing from family members and friends - as many as 24.3 percent of micro enterprises and 7.5 percent of small enterprises, according to Ba's study.

A compelling survey result is that although 66.7 percent of SMEs regard bank loans as a primary financing measure, 62.1 percent of them have never had a bank loan.

The difficulty is compounded by a structural gap between what financial institutions offer and what SMEs really need. One-third of SMEs need medium- and long-term loans to upgrade their equipment or invest in new products, the survey found, yet 63.3 percent of loans they got were short-term, less than a year.

"This stands in conflict with the fact that, driven by fiercer competition, 39.3 percent of SMEs have considered improving their product quality, 43.9 percent of SMEs have considered extending their product chain and 27.7 percent have considered upgrading their technology," said Ba.