|

|

File picture shows a Chinese New Year lantern installation on display outside a Sinopec gas station in Hong Kong. [Photo/Agencies] |

China has now been home to the world's second-largest number of Fortune 500 companies for five consecutive years.

According to this year's Fortune 500 list, the number of shortlisted Chinese companies rose for the 12th year in a row to 106, with six more entering for the first time, including Shaanxi Coal & Chemical Industry Group Co Ltd, China Everbright Group Co Ltd and HNA Group.

The United States still has the largest number, 128, unchanged from last year, but the list's compilers estimate that China will overtake the US tally by 2020.

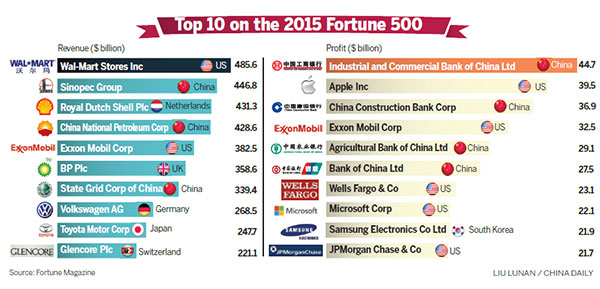

US retail giant Wal-Mart Stores Inc claimed top spot again with sales revenue reaching $485.65 billion in 2014.

Second to Wal-Mart is China's State-owned oil giant China Petrochemical Corp, better known as Sinopec Group, with a total sales revenue of $446.81 billion in 2014, which pushed last year's runner-up Royal Dutch Shell Plc into third.

Due to the global economic slowdown, the total profit made by all the Fortune 500 companies actually fell 14.76 percent to $1.67 trillion in 2014.

The threshold for being included in this year's list, however, rose by 0.49 percent to $23.72 billion of sales revenue.

In the sub-list of the most profitable companies, 13 out of the 50 finalists were from China.

Industrial & Commercial Bank of China Ltd topped the list with total profits of $44.76 billion last year, better than Apple Inc and Exxon Mobil Corp.

State-owned grain trader COFCO Corp, meanwhile, saw its position rise the most, jumping from 401 to 272. China Merchants Bank Co Ltd enjoyed the second-best growth rate, with its position rising to 235 from 350.

Notably, the majority of the shortlisted 106 Chinese companies were State-owned, with 47 directly under the control of the State Assets Supervision and Administration Commission.

Li Jin, a researcher with the commission, said the growth in revenues by the country's SOEs was very much in line with the country's increased contribution to global GDP and its rising economic influence.

Experts expressed concern, however, that few privately owned companies had featured as strongly as their SOE counterparts, although they provide the most job opportunities in China.

Adam Xu, a partner at market consultancy Strategy&, described China "as a country where State enterprises dominate many segments of the economy".

Worrying too, 13 Chinese companies found themselves in the sub-list of "the top 50 companies which suffered the greatest losses".

Leading that list was Aluminum Corp of China Ltd, which lost $1.76 billion last year.

Despite many growing in size and scale, the ability of some Chinese giants to make a profit was also noted.

Exxon Mobil's sales revenue was much smaller than Sinopec's, for example, but its profit is at least six times the size.

Renowned economic commentator Wu Xiaobo recently highlighted the difficulties being felt by the growing crop of mobile and technology firms, for instance, which could also be applicable to many other Chinese companies.

"The traditional advantages of the 'made in China' manufacturing equation of large scale plus low cost is becoming unreliable and worthless for many."