|

|

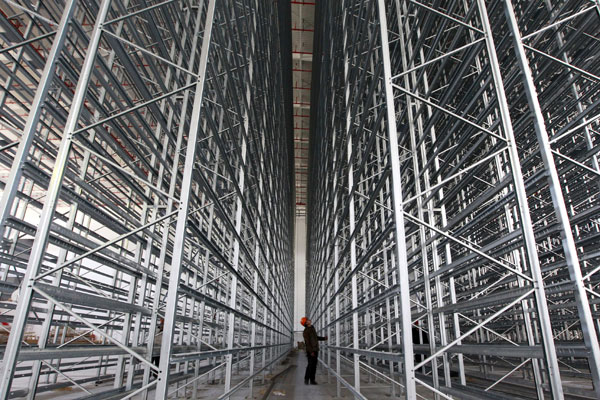

An automatic distribution center, the largest in terms of daily handling capacities in Asia, will be in operation in July in Shanghai. To cope with the e-commerce surge, as much as $2.5 trillion may need to be invested in land and warehouses over the next decade and a half, one builder said. Pei Xin / Xinhua |

Alibaba Group Holding Ltd's plans for a giant initial public offering in New York highlight the vast potential for e-commerce in China - and the weak link the logistics industry must fix if those explosive growth projections are to be reached.

The aging warehouses that supply goods to customers across the world's second-largest economy are already creaking under the strain, lacking the state-of-the-art technology that has fueled the rise of Amazon.com Inc.

|

|

|

|

That's drawing the attention of global private equity firms like Blackstone Group LP and Carlyle Group LP.

"The real cost of building warehouses is going to be staggering," said Jeff Schwarz, cofounder of Global Logistic Properties Ltd (GLP), the biggest foreign builder of logistics facilities in China. That translates to about 2.4 billion square meters of new warehouses - or two-thirds of the land mass of Taiwan.

Alibaba controls 80 percent of all online retail in China, and its logistics partners delivered 5 billion packages last year. While transport has kept pace with Alibaba's rise, warehousing is in serious need of a makeover. Fewer than 20 percent of China's warehouses are categorized as modern, with fully computerized tracking systems and the latest in retail technology, according to GLP.

And many facilities serving Alibaba and its peers are in areas that are tough for trucks to access. They often lack raised loading bays to let packages roll off conveyor belts: Instead, the vehicles are loaded by hand.

That can cut into profits. Despite China's wages being much lower than those in the US, it can cost over twice as much to transport goods in China, GLP said.