The government austerity drive and a slowing economy have dealt blows to the sale of consumer goods, particularly luxury brands and high-end products, Wang Zhuoqiong reports

China's slowing economy, as well as the government anti-corruption campaign, have weakened the growth of many international companies. Experts predict dimmer prospects for consumer spending this year.

Zhao Ping, deputy director of the department of consumer economics at the Chinese Academy of International Trade and Economic Cooperation, said retail sales growth stood at 13.1 percent in 2013, down from the 14.3 percent growth logged in 2012 and 17.1 percent in 2011.

|

|

|

|

Although the figure seemed positive compared with the sluggish markets of Europe and the United States, they reflect an obvious slowdown from the double-digit growth of previous years, he said.

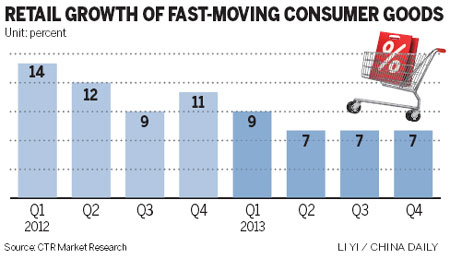

According to China Media and Market Trends of 2014, research conducted by CTR Market Research, sales growth for fast-moving consumer goods sank to 7 percent from 11 percent in the fourth quarter of last year.

"Such weakened growth has had a major impact on many consumer businesses," Yu said.

The austerity campaign designed to curb consumption of luxury products using public funds greatly affected the sales of high-end products and luxury brands in the country, Yu said. He cited foreign alcohol, wine and tobacco as examples.

"The macroeconomy has more or less curbed the desire to purchase," he said. "Consumers are reluctant to spend."

He observed that the buying of household items from State-owned enterprises or government institutions for employee welfare also has dropped significantly.

Food marketer Nestle and liquor seller Pernod Ricard SA attributed their weak results in part to struggles in emerging economies.

Many European companies had relied on sales in markets such as China, Brazil and Mexico to maintain revenue momentum while developed markets remained sluggish.

Don't miss:

|

|

|

| China's top 10 richest cities |