Middle East a market to be tapped on the Road

|

|

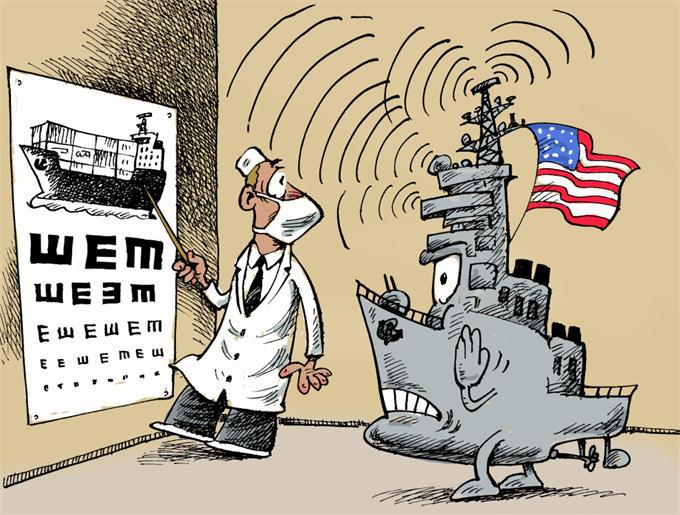

The first regular container train linking China to the Middle East is unveiled in Yiwu, East China's Zhejiang province, Jan 28, 2016. The train will exit China through Alataw Pass in Northwest China's Xinjiang and pass through Kazakhstan and Turkmenistan before reaching its destination Tehran, capital of Iran, completing a 14-day and 10,399-kilometer journey. [Photo/Xinhua] |

Which makes sense given that most Western investors would refrain from venturing into non-Arab markets in the region such as Iran and the Beijing-proposed Belt and Road Initiative is driving Chinese investment to the oil-rich Middle East, once a pivot on the ancient Silk Road.

China has earned itself a reputation for "getting things done" in major infrastructure projects at competitive costs and speed, as well as making the most of State-directed investment. It signed 14 cooperative agreements when Saudi Arabian King Salman bin Abdulaziz Al Saud visited China in March, including projects worth about $65 billion, from production capacity to investment cooperation. Last month, an electric train project in Iran backed by Chinese enterprises, which will connect Teheran and the northeastern city of Mashhad, also received government funding.

In essence, these mega projects are reciprocal and of course, costly. But the appealing long-term gains are not a pie in the sky as they can be achieved through proper management and streamlined coordination. The real risk is that despite the benefits and efficiency of Chinese enterprises-led construction, local people may have little idea of China's presence in the Middle East.

Unlike products imported from the West or even the Republic of Korea, people in the Arab world have little knowledge about Chinese-assisted infrastructure programs. Few have a clear idea of the rise of China, let alone the Chinese companies that designed and built their tunnels, or the Chinese gantry cranes used at their ports and Chinese engineers who work on their oil fields.

Besides, some Middle East commodity peddlers buy shoddy goods from China and retail them in their countries, dealing a blow to the image of Chinese products, with which local consumers are not familiar in the first place. These investment disadvantages, along with security risks, have dissuaded many Chinese entrepreneurs from looking to the Arab markets.

Much of the untapped business potential in the Middle East can be exploited, though, as long as one knows how to go about it. But some Chinese investors seem to be influenced more by the stories of failed adventures of their peers, who suffered huge losses in their Middle East ventures because of the lack of legal assistance and investment counseling.

The fact is that Middle East states have an established, time-tested market code of conduct because of their dealings with European and US business people over the decades. So, prospective Chinese investors need to do their homework before making a foray into the Middle East market.

The US factor, too, should be taken into account. Syria and Iran are high on the US sanctions list, meaning doing business with those two countries can be tricky given the pivotal role of US components and the dollar in international trade.

The author is an associate professor at the University of International Relations.