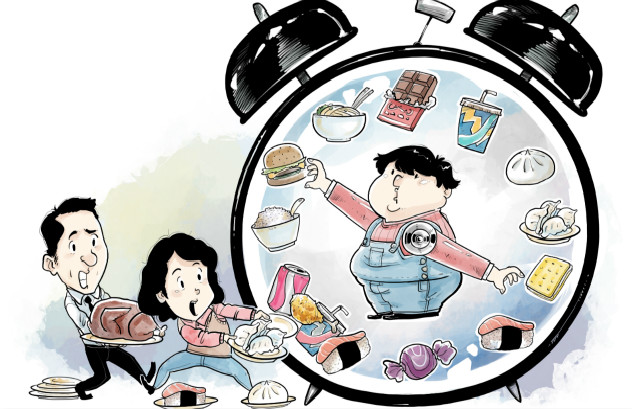

Dirty means to beat realty rules

Some couples are using divorce as a pretext to overcome the restrictions imposed on purchase of houses or avoid paying relevant property taxes. The restrictions have been imposed by the central and local governments to cool down the housing market, and it's shocking to see that some couples are using immoral means to avoid them in their quest to amass wealth, says an article on gmw.cn. Excerpts:

The need for a house can indeed force some couples to try and bypass some rules. But couples who use "false divorce" cases to buy a house or houses to cash in on the rising housing prices should be condemned.

Housing prices have been rising despite the central government's continued efforts to cool down the real estate sector. The latest government measures include a 20 percent capital gains tax on home sales and restrictions on the purchase of a second house.

A close look at local regulatory policies reveals that local governments have taken short-term measures such as higher mandatory mortgage down payments. They, however, have paid less attention to long-term policies like property tax and other measures. As a result, while they have been trying to curb some speculative demand, their policies have accidentally had a different sort of impact on rigid demand.

If policymakers don't change their focus, rising property prices will force more people to use unscrupulous and immoral means not only to buy a house to live in but also to make profit.

Therefore, a multi-layer and long-term sustainable policy system for the property market should be established after considering the overall social and economic development, social justice and fairness as well as social harmony and stability. Besides, while making policies, local governments should pay closer attention to well-targeted measures for the housing market.