HK helps RMB's global rise

Nation's opening-up of bond market and liberalization gives impetus to currency's internationalization efforts

|

|

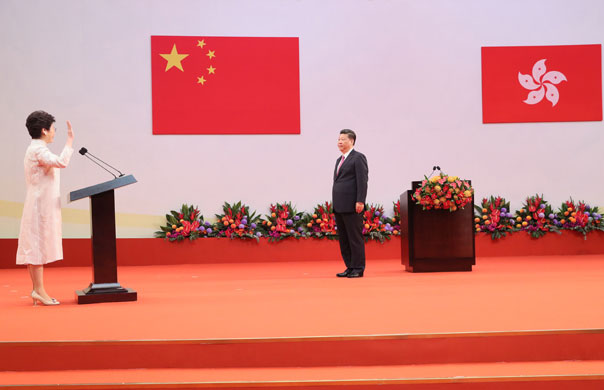

Hong Kong is the most important offshore renminbi center in the world due to its leading position in renminbi liquidity and reminbi-denominated assets. The city's financial sector has pledged to get global investors to ride on the renminbi's ascent to being a global reserve currency. Photo provided to China Daily |

Hong Kong has made significant contributions to the renminbi internationalization effort in the past two decades, with the city's mature, robust financial system acting as a lever in the process.

The central government's push to make the renminbi a global currency comes in three phases-using the renminbi for trade settlement, for investment and as a reserve currency.

The SAR's role in the drive started in November 2001 when the Hong Kong Monetary Authority (HKMA)-the city's de facto central bank-suggested to the People's Bank of China (PBOC) that personal renminbi business be introduced in Hong Kong. The plan was approved by the State Council in late 2003 and Hong Kong became the first offshore renminbi market to provide a full range of renminbi banking services in February 2004.

In terms of facilitating cross-boundary trade flows, renminbi trade settlement handled by Hong Kong banks had ballooned from 2.63 trillion yuan ($385.3 billion) in 2012 to 6.83 trillion yuan in 2015 before falling by 33.5 percent to 4.54 trillion yuan last year, according to HKMA figures.

Hong Kong currently accounts for more than 60 percent of global renminbi trade settlement, according to Bank of China (Hong Kong) (BOCHK).

"The Belt and Road (B&R) Initiative mooted by President Xi Jinping in 2013 will further stimulate the renminbi's use in cross-boundary trade settlement," said Lian Ping, chief economist at Bank of Communications Co.

"In particular, the Chinese mainland is the largest commodity importer country for commodities exported by the B&R countries (and regions). This should elicit demand for renminbi for settling cross-boundary commodity transactions," Lian told a business forum in June.

Hong Kong is the most important offshore renminbi loan center, with the total outstanding Hong Kong renminbi loans, cross-boundary direct renminbi loans and renminbi trade finance reaching 300 billion yuan, according to BOCHK.

As of April last year, Hong Kong accounted for 38 percent of the daily renminbi foreign exchange turnover of $202 billion, posting a cumulative gain of 68 percent, compared with three years ago, according to Bank for International Settlements.

Hong Kong has also made major strides in promoting the renminbi as an investment currency since the handover.

The SAR boasts having the largest offshore renminbi liquidity in the world. While renminbi deposits in the city had exceeded 1 trillion yuan by December 2014, they amounted to 528 billion yuan in April this year, HKMA data showed.

Hong Kong is also the most important offshore renminbi-denominated bond issuance center, with the amount of dim-sum bonds issued annually having catapulted to 200 billion yuan during peak periods, well ahead of other offshore yuan financing centers, according to BOCHK statistics.

The PBOC approved the Renminbi Qualified Foreign Institutional Investor (RQFII) program in 2011. Hong Kong was the first financial market to be awarded a RQFII quota and has been granted a total of 270 billion yuan to date.

"The renminbi internationalization should not only be measured in terms of the amount of renminbi deposits and loans. A more appropriate gauge is whether the market can be provided with sufficient financial products for hedging the currency, whether the size of renminbi-denominated financial assets under management is huge; and whether there are a variety of renminbi-denominated financial products," said Yue Yi, vice-chairman and chief executive of BOCHK.

Four other major capital market liberalization steps initiated by the central government-the Shanghai-Hong Kong Stock Connect launched in November 2014, the Mainland-Hong Kong Mutual Recognition of Funds in mid-2015, the Shenzhen-Hong Kong Stock Connect which started in December last year, and the upcoming Bond Connect-will further stimulate use of the renminbi as an investment currency.

"Without the opening-up of the country's bond market, it'll be difficult for the renminbi to be genuinely internationalized," said Ba Shusong, chief China economist at Hong Kong Exchanges and Clearing Ltd.

"An active, deep and mature bond market can help banks allocate their assets, as well as in hedging and conducting risk management. By luring overseas capital to invest in the onshore interbank bond market, the Bond Connect will be important in eliciting cross-boundary fund flows to the country," Ba said.

The landmark inclusion of A shares in Morgan Stanley Capital International's Emerging Markets Index in mid-June this year will also provide impetus for the continued internationalization of the renminbi as a global investment currency.

"The inclusion of A shares in MSCI's EMI can be important in as much as it reassures global investors about the Chinese mainland's ongoing integration into the global financial system," think-tank Oxford Economics said in its research note.

The renminbi's ascent to being a global reserve currency marked a new milestone following its landmark inclusion in the International Monetary Fund's Special Drawing Rights (SDR) in October last year. The reserve currency basket was created in 1969 to supplement a shortfall of preferred foreign-exchange reserve assets, namely gold and the US dollar.

Hong Kong should strive to attract overseas central banks to establish their investment platforms in the city as global reserve managers are poised to enhance their weightings in renminbi assets after the currency's inclusion in the SDR. BOCHK estimates that overseas central banks will invest $680 billion in renminbi assets by 2025, accounting for 10 percent of the world's official currency reserves.