Clarity on tax evasion needed, lawmakers told

Former flight attendant convicted of smuggling will face retrial

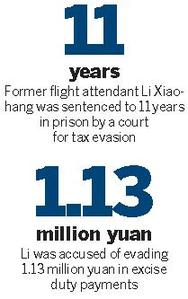

Lawmakers have been urged to clarify guidelines on how courts gauge the severity of excise-tax evasion, after a fallout over a flight attendant sentenced to 11 years in prison for smuggling makeup from South Korea.

Li Xiaohang, a former Hainan Airlines employee, was convicted in July. However, Beijing High People's Court confirmed on Tuesday she will face a retrial.

"The reason (for the retrial) is that facts are unclear and evidence is insufficient," court official Guo Jingxia said.

At her trial, Beijing No 2 Intermediate People's Court heard that Li, 30, brought makeup from duty-free shops in South Korea through Chinese customs among personal belongings and then sold it online. She did this nearly 30 times from 2010 to August 2011, according to the verdict, evading 1.13 million yuan ($183,600) in excise duty payments.

She was also fined 500,000 yuan.

The intermediate court said in a statement it has been told to retry the case, but gave no further details.

Zhang Yan, Li's attorney, said he is preparing for the retrial. He said there are problems with the verification of Li's tax evasion, and he feels the sentence is too harsh. Zhang appealed to the higher court in September.

"Customs didn't provide clear evidence on how much tax Li evaded," he said. "Instead, they just gave four statements showing some online orders," he said, adding that it is unreasonable to deliver the verdict according to "vague" statements from customs authorities.

Zhang said the retrial has given Li's family hope, and may result in a lighter sentence. He said the case will be reheard within three months.

Before the Criminal Law was revised in 2011, regulations stated people should be sentenced to 10 or more years if the amount of tax evaded on smuggled goods reached 500,000 yuan, but Li said this figure is deleted in the latest version.

"Specific figures became 'relatively large amount', 'huge amount' and 'extremely huge amount', which is hard for courts to verify," he said.

Legal experts said many Chinese bring products in from overseas for themselves or to sell online, which can easily lead to legal disputes and may involve smuggling.

Han Yusheng, a professor of criminal law at Renmin University of China, said judges have various understanding about the law and have given different sentences for similar cases.

In February, a Shanghai court sentenced two women shop owners to a year in prison, suspended for 18 months, for buying duty-free goods in South Korea and bringing them into China to sell on the Internet in 2012.

Han said the "vague" article of the law affects verdicts and extends judges' discretionary power.

Han called for a standard interpretation.

"The interpretation would reduce unnecessary legal disputes and controversial verdicts and can also avoid different punishments for the same crime," he said.

In Hong Kong, there is a clear regulation on how many cigarettes and how much milk powder people can carry through customs, he said, adding the Chinese mainland should learn from such a practice.

Wu Ming'an, a professor specializing in criminal law at the China University of Political Science and Law, said courts should pay attention to why people bring in duty-free products.

"Some have no idea about customs regulations and just bring duty-free goods for themselves and friends, which should attract a light punishment, because most of them do not intentionally evade tax."

He also suggested that customs should strengthen inspections and introduce stricter punishment for people who smuggle products and intentionally evade large amounts of tax.