China brings luster to foreign firms

BEIJING - The lure of the Chinese market to foreign multinationals is gaining new luster as the rebalancing in the world's second largest economy hits the sales and strategy of companies around the world.

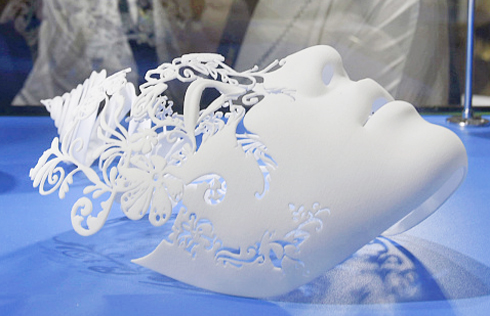

As an increasingly mature economy, China is moving up the value chain by rapidly developing its service and advanced manufacturing sectors. Foreign Direct Investment (FDI) in China reflects this transition.

A survey from the US Chamber of Commerce in Shanghai showed 77 percent of US companies in China were making profits in 2016, up 6 percentage points from 2015. Some 73.5 percent reported increased revenue, up 12 percentage points from a year earlier.

FDI inflow into high-end sectors has been clear for all to see.

In the first half of 2017, FDI into China's high-tech manufacturing and services rose 11.1 percent and 20.4 percent year on year, respectively, outstripping general FDI growth rates.

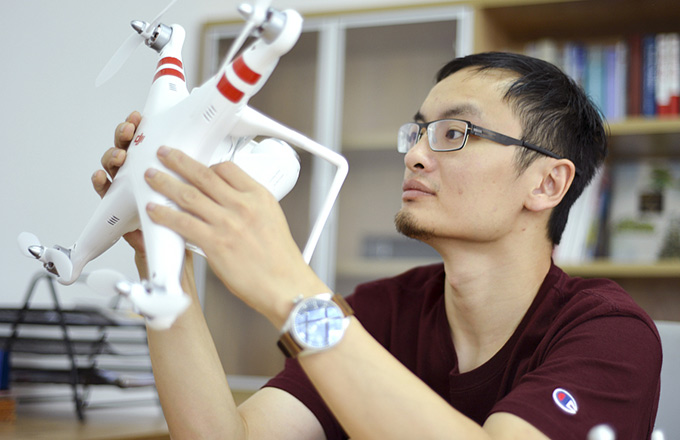

From shared bikes to electric cars to smartphone payments, foreign investors are joining the market.

China's top bike-sharing companies, ofo and Mobike, have attracted investment from countries such as the United States, Japan and Singapore. Tesla has Asia's largest supercharger station in Beijing and plans to add over 300 supercharger stalls in the country this year. Mobile payment service Apple Pay recently launched its largest-scale marketing campaign since entering China.

Such investment is increasingly about leveraging a booming Chinese consumer market and meeting China's desire to develop innovative high-tech industries.

The appeal of nearly 1.4 billion consumers and an economy in a historic transitioning has brought over $1.7 trillion of investment to China and will continue to create tremendous business opportunities.

A survey from the European Union Chamber of Commerce in China showed that 51 percent of EU business in China said they would boost their presence, compared with 47 percent recorded in 2016. According to a UN survey, China remains one of the most popular destinations for multinationals.

Over the past three decades, multinationals have played an overwhelming role in China, bringing money, know-how and jobs to the once-closed economy that is now eager to become open and market-driven.

FDI still makes great sense in China today, as the government looks to make it a pillar of the country's new, consumption economy -- a driver of the great rebalancing.

From R&D centers and technological spillover to the acquisition of world-class management skills, the impact of FDI in China is huge.

Countries are vying for more high-quality foreign investment, and China is no exception.

The Chinese leadership has promised to create "a stable, fair, transparent and predictable business environment" with a range of deregulation measures under way.

China has created 11 free trade zones where foreign firms can escape red tape when applying for registration. It is shortening the list of sectors that are off-limits to foreign investors, as with reducing market entry restrictions for industries such as transport and financial services.

Policy transition takes time, and any dissatisfaction with China's slow progress in opening up investment markets could be jumping the gun. There should be no doubts about China's commitment to and capability of opening up further.