China's economic indicators picked up slightly in November after a three-month cooling, led by accelerated industrial output, boosting hopes that the annual growth target of "around 7 percent" may be achieved.

As earlier policies to stabilize growth are taking effect, the overall economy is expected to rebound gradually, said Sheng Laiyun, spokesman for the National Bureau of Statistics.

"I am confident we will achieve the annual growth target," he said.

The NBS released November's major economic indices on Saturday.

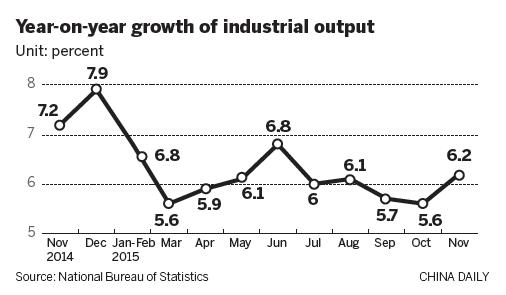

Industrial output growth strengthened to 6.2 percent year-on-year and hit its highest level since June, up from 5.6 percent in October, supported by the fast growth of automobile output.

Fixed-asset investment accelerated to a year-on-year growth rate of 10.2 percent in November, compared with 9.5 percent in October, driven by the stable expansion of infrastructure construction and manufacturing investment, although real estate construction is continuing to suffer a downturn.

Retail sales growth, meanwhile, edged up to 11.2 percent from 11 percent in October and remains the strongest driving force of overall economic growth.

Economists predicted that GDP growth in the last quarter may reach 6.9 percent, unchanged from the third quarter. In the first half, the growth rate averaged 7 percent.

Louis Kuijs, an economist at Oxford Economics, said: "The macro policy-easing measures taken earlier this year have had a favorable impact on growth in the fourth quarter."

The policies include five cuts in the benchmark interest rate, four cuts to the reserve requirement ratio for financial institutions, the acceleration of approvals for infrastructure construction projects and an increase in the quota for local government debt swaps.

"We expect the government to continue to take incremental measures to support domestic demand-with an increasing emphasis on fiscal measures-to ensure that GDP growth does not deviate too much from its growth target," said Kuijs, who thought that the risk of a hard landing remains low, but a further weakening of housing sales momentum could lead to a more pronounced slowdown.

An earlier research note from Goldman Sachs, said that meaningful policy support and more effective policy transmission to the real economy will be required next year, even if the official target for GDP growth is expected to lower to 6.5 percent.