Sinopec looks north for oil

|

|

Talks under way with Iceland for cooperation on energy projects

China is increasing its presence in the resource-rich Arctic, with its second-largest domestic oil company acknowledging ongoing involvement in oil exploration and development in the far north.

A source from Sinopec Group, Asia's top refiner, confirmed to China Daily on Monday that the company is holding preliminary talks with Iceland over oil exploration off the northeast coast of the Nordic country.

The source said the talks are being held between the Icelandic government and Sinopec Star Petroleum Co Ltd, a clean energy subsidiary wholly owned by the group, but the person declined to release more details.

However, the source said that since there has been cooperation between Sinopec and Iceland in the geothermal energy sector, it is very likely that the two parties will cooperate further in oil and natural gas.

In April 2012, Fu Chengyu, the chairman of Sinopec, signed a framework agreement on the expansion of geothermal development and cooperation with Haukur Harearson, chairman of Orka Energy Holding Ehf, witnessed by then-premier Wen Jiabao and Icelandic Prime Minister Johanna Sigurdardottir.

The two companies formed a joint venture named Sinopec Green Energy Geothermal Development Co Ltd in 2006.

CNOOC Ltd, the biggest offshore oil producer in China, was the first Chinese oil company to gain a foothold in the Arctic region through a partnership with Iceland-based Eykon Energy to bid for an exploration license.

On May 15, China secured observer status on the Arctic Council, an eight-member regional decision-making body. Observers have no voting rights, but they do have the right to propose and finance policies.

A Sinopec source who declined to be identified said the company's overseas acquisition targets were formerly in the Middle East and then shifted to Russia and Africa. Now, the source said, the company is broadening its view in terms of the location of opportunities.

However, experts said the exploration costs in Iceland will be extremely high, and the work will require advanced technology, which will pose major obstacles for the Chinese explorers.

Besides, it is very likely that they will face objections by environmental groups once work on projects begins.

Andy Brogan, global oil and gas leader with Ernst & Young, told China Daily on Monday that the Icelandic government will be sensitive about environmental protection in the area. But he added that the country is also very pragmatic about the economic benefits of energy exploration.

"It is still too early to predict how successful the deals can be," he said.

Heavily indebted Iceland is hungry for foreign investment. The country was severely hit by the financial crisis that erupted in 2008.

Its financial sector, with a balance sheet 10 times that of the country's economy, collapsed.

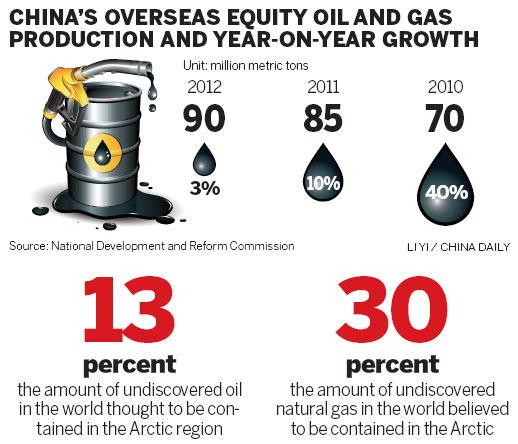

The Arctic, the area north of the Arctic Circle, is thought to contain 13 percent of the world's undiscovered oil and 30 percent of its undiscovered natural gas, according to a report by Ernst & Young released on Monday.

Figures from the United States Geological Survey show that oil reserves in the Arctic stand at about 90 billion barrels.

As China's oil consumption is increasingly depending on foreign supply, it is clear that top oil and gas players in the country are moving faster to find and exploit resources overseas.

Sinopec has moved overseas a little slower than the other two big oil companies, CNOOC and China National Petroleum Corp, the country's largest oil and gas producer, which took their first steps abroad in 1993.

Sinopec only began to participate in the global natural resources market in 2009 by acquiring Addax Petroleum.

"Chinese oil companies have tended to invest in overseas resources in stable regions rather than high-risk areas in recent years," said K.C. Yau, partner with Ernst & Young.