Baidu profit growth drops for 8th quarter

Search engine giant pins hopes on mobile sector, 'but it takes time to yield gains'

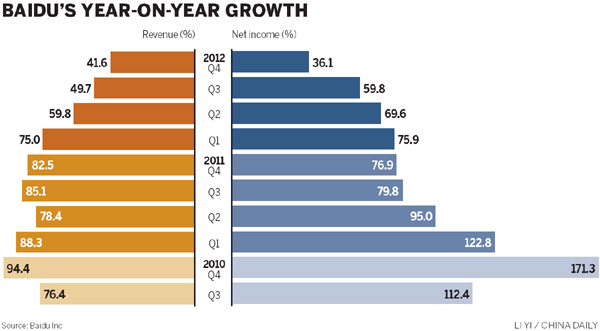

Baidu Inc, China's largest search engine, saw the growth rate of its net profits decline for the eighth consecutive quarter since the first quarter of 2011, as attempts to find a way to fuel growth after years of quick development failed to bear fruit.

Analysts remain conservative on the company's progress in translating traffic into revenue in the mobile sector, which Baidu said is the focus of its future strategy.

The company generated most of its revenue from search advertising. The year-on-year growth rate of its net income reached 171.3 percent in the fourth quarter of 2010, after rival Google Inc shut down its Chinese mainland service and redirected traffic to Hong Kong that year.

However, the rate dropped to 36.1 percent last quarter, according to the company's financial reports.

The company has pinned its hopes for the future on the mobile sector, as an increasing number of Chinese people access the Internet with mobile devices.

Robin Li, chairman and CEO, said on Tuesday that Baidu will increase its workforce in research and development this year to boost growth in the sector.

"Desktop search has been soft during the past quarter, and we expect that trend will continue for the coming year ... So desktop search will continue to be an important way for people to find information, but the real growth side is in mobile," Li said in a conference call.

The company has released an updated version of its mobile browser and increased cooperation with handset providers in recent months.

However, Li said it will take two years to properly generate income from mobile services, the same situation faced by most Chinese Internet companies that find mobile traffic rising but haven't been able to make much money from it.

Qiu Lin, a stock analyst with Guosen Securities Co in Hong Kong, said the prospects for Baidu are pessimistic in the short term.

"The growth rate of Baidu's revenues has been declining and this trend is likely to continue in the first and second quarters this year," he said.

He cited reasons that include Li's remarks about the "soft" growth of desktop search; the little revenue that mobile search contributes to the company currently; and increasing competition from rivals such as anti-virus software maker Qihoo 360 Technology Co Ltd.

Lina Choi, vice-president and senior analyst of Moody's Investors Service Hong Kong Ltd, agreed.

Baidu's "mobile search initiatives, while generating more usage and traffic, have led to a lower conversion rate and lower cost per click, and eventually lower revenue per customer in the early stage of business development," Choi said in a research note.

However, she said Baidu's overall profitability is still high, as is evident in its 2012 operating margin of 49.5 percent.

In 2012, Baidu reported total revenue of 22.3 billion yuan ($3.58 billion), a 53.8 percent increase from 2011. Its net income was 10.46 billion yuan, up 57.5 percent from 2011, according to its financial report.

"In addition, Baidu's core revenue and cash flow, derived from a growing online search market, remain healthy and support its strong credit profile," Choi said.

Li said the company may also have mergers and acquisitions this year in vertical search and the mobile sectors.

In 2011, Baidu bought a majority stake in Qunar.com, the country's leading travel website, to strengthen its position in the travel search sector.

Baidu claimed a dominant share of China's search market, with 78.6 percent in the fourth quarter last year, while Google had 15.2 percent, measured by revenue, according to domestic research company Analysys International.

chenlimin@chinadaily.com.cn