Alliances to extend Alipay's presence in US market

|

|

An app of Alipay, China's biggest third-party payments platform, on a mobile phone. [Photo/VCG] |

Ant Financial Services Group, the operator of China's most used mobile payment service Alipay, will soon enable its hundreds of millions of Chinese users to enjoy data-driven in-store payments in the United States-the latest effort made by the digital financial service giant in its moves to go global.

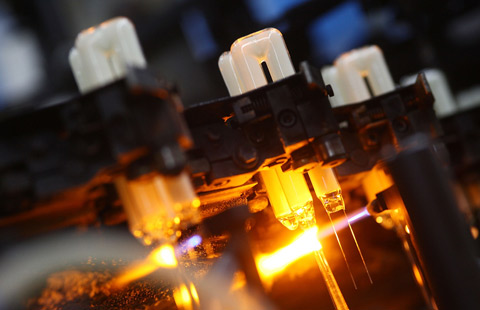

Ant Financial, which is controlled by Chinese billionaire Jack Ma, announced on Tuesday its partnerships with US payment technology providers First Data Corp and Verifone, an initiative that is expected to help the Chinese company rapidly expand its presence in the country via the two partners' strong merchant networks.

Douglas Feagin, senior vice-president of Ant Financial and head of Alipay International, said in a keynote speech at Money 2020 in Las Vegas that the US market was vital for Alipay not only because it is a popular destination of Chinese visitors and tourists.

"We aim to have at least 1 million merchants outside the Chinese mainland accepting Alipay worldwide in three years. Working with our network of global partners like First Data and Verifone will help us achieve the goal."

Since late 2014, Alipay has worked closely with local retailers at popular destinations for mainland visitors and tourists, including South Korea and Hong Kong.

By having First Data and Verifone join Ant Financial's network, combining with many other partners worldwide, Chinese visitors and tourists will be able to pay and receive interactive information from global merchants from Europe to North America, Japan to Southeast Asia.

The move in the US is part of Ant Financial's broad global expansion plan of serving 2 billion customers in the next 10 years, about 60 percent of them coming from outside China.

Li Chao, an analyst with iResearch Consulting Group, said that the rising number of Chinese outbound travelers and their increasing spending were part of the emerging "going global" trend fueled by China's mobile payment service providers.

"Fierce competition has dragged down the profits of digital payment services in China," he said.

"Looking abroad is in line with their internationalization strategy and the goal to be more profitable. And the best way to start is with Chinese outbound travelers."

Outbound tourism has become increasingly popular among Chinese middle-class consumers in recent years. According to the United Nations World Tourism Organization, China has been the world's biggest outbound tourism consumer since 2012, accounting for more than 13 percent of global tourism revenue.

In 2015, China saw 117 million tourists traveling overseas and they spent $104.5 billion overseas.