Two boys check out a concept car at an auto show in China. Jing Wei / for China Daily

Marques realize they must adapt to attract more car-savvy and demanding buyers

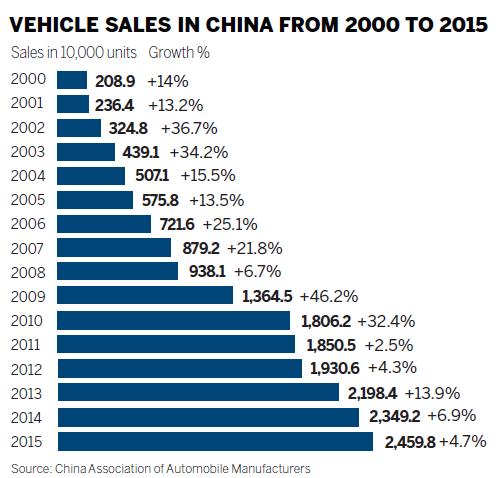

China sold 6.59 million cars in the first quarter of 2016, a 6.2 percent growth year-on-year, in line with the China Association of Automobile Manufacturers' annual prediction.

While the growth rate represents a healthy number from a global perspective, many in the industry have been lamenting the golden days of double-digit growth in the world's largest car market.

Today, car brands are gradually realizing that they must adapt to attract a population of buyers that is becoming younger, more car-savvy and demanding. Several forward-thinking automakers have already sprinted to a small lead.

On April 19, Cowin, a newly launched brand under Chery Auto, showcased its first car, a crowdsourced midsized SUV that involved more than 1 million participants since responsibilities for the model were assigned through the internet from July 2015.

Its president Zheng Zhao rui said netizens helped come up with a design sketch and the car's name, the Cowin X5.

"We don't think Italian designers in their 50s will surely meet the taste of the post-1990 generation in China, so we let young netizens make those decisions," Zheng said.

Earlier this month, Next-EV, a Chinese startup aspiring to make electric and smart supercars, inked a 10 billion yuan ($1.5 billion) deal with JAC Motors to produce connected vehicles. NextEV was founded in 2014 by William Li and a group of internet entrepreneurs.

Li said NextEV is meeting the demands of a customer base that grew up in the age of the internet.

"Take the iPhone for example. It doesn't have great voice clarity or battery life, which used to be two hallmarks of a great mobile phone. Instead, it changed the way we evaluate mobile phones. We now agree that apps and touch screens are more important.

"For the auto industry, electrification and the mobile internet will do the same thing as iPhones have done. They will help make cars more fun and be more than a tool of transport."

Both Cowin and NextEV's achievements have come after China initiated its "supply-side" reform last year aimed at reducing overcapacity, improving products and service quality and boosting productivity through innovations. Ultimately, the nation's policymakers hope these measures stimulate consumption.

In response, international car giants have changed their strategies to consolidate their positions in the country.

"China will be the fastest-growing market for new-energy vehicles worldwide," said Matthias Muller, CEO of Volkswagen Group. "So for us, it's crystal clear: The future of e-mobility is strongly connected to this market. In China, the future is now."

He said Volkswagen is empowering regional markets to be more responsive to customer demands and tastes, particularly those in China, where 15 new locally produced new-energy vehicles will be rolled out by 2020.

The new-energy vehicle market is growing rapidly in the Chinese market. Sales of NEVs in the first three months of the year totaled 58,125 units, a 100 percent rise year-on-year, according to the China Association of Automobile Manufacturers.

At the Beijing motor show, which opens on Monday, 147 of 1,179 vehicles displayed are new-energy models.

Muller also emphasized the importance of digitization and connectivity, saying that they will alter the automotive industry.

"If the automotive industry does not want to run the risk of having its status downgraded to that of a hardware supplier, we have to make sure we take advantage of the big technological trends ourselves."

The mobile internet is surging in many countries, especially China. There were 899 million active smart mobile devices by the end of last year in China, accounting for 69 percent of the country's population, according to QuestMobile.

GM is implementing a plan to improve personal mobility solutions with such tools as ride-sharing, car-sharing and autonomous driving.

By the end of the year, GM will have 12 million OnStar-connected vehicles on roads. In China, all Cadillac, Buick and Chevrolet models will be connected by 2020.

Earlier last month, Shanghai OnStar inked a deal with China's home appliances producer Midea Group to integrate onboard telematics and smart household technologies into vehicles.

Record recall total

Besides their enthusiasm with connectivity, domestic customers are becoming more and more demanding of quality.

Automakers recalled more than 5.5 million cars last year, a record high, in the Chinese market.

"Customers are getting younger and younger," said John Zeng, managing director of LMC Automotive.

"They know more about cars than those born in previous generations and they want to defend their rights."

Geoff Broderick, general manager of Asia-Pacific Auto Operations at JD Power, said "quality is a nonnegotiable factor" in China as "there are no second chances with over 500 models for a consumer to choose from".