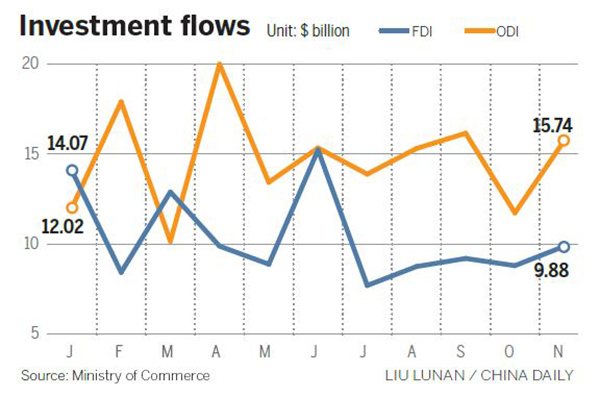

Non-financial ODI up in Jan-Nov

China's outbound direct investment from the non-financial sector stood at around 1.07 trillion yuan ($161.7 billion) in the first 11 months, up 55.3 percent on a year-on-year basis, according to data released by the Ministry of Commerce on Thursday.

Chinese companies completed 561 merger and acquisition deals in global markets between January and November this year, and $82.4 billion or 30 percent of their total investment flowed into manufacturing businesses.

Ministry spokesman Sun Jiwen said the investment categories of Chinese companies have been further expanded in overseas markets. High-end manufacturing, information and software technology services were hot areas for China's ODI over the past months.

Major investment destinations were members of the Association of Southeast Asian Nations, Australia, the European Union, Russia and the United States. "Countries and regions along the Belt and Road Initiative remained hot destinations as companies deployed their financial resources," said Sun.

The trade, services and infrastructure network proposed by China in 2013 envisions a Silk Road Economic Belt and a 21st Century Maritime Silk Road, covering about 4.4 billion people in more than 60 countries and regions in Asia, Europe and Africa.

Chinese companies signed 7,367 projects including dams, stadiums, airports and power stations in countries along the routes between January and November, with a contract value of $100.36 billion, up 40.1 percent on a year-on-year basis. These projects accounted for 52 percent of China's newly signed contractual foreign projects.

"China's investment in railway projects in African countries including Nigeria, Ethiopia and Djibouti has also boosted exports of the country's power-generating equipment, construction machinery, building materials, telecommunications, railway vehicles and signal systems," said Lin Guijun, a professor at the University of International Business and Economics in Beijing.

Lin said Chinese enterprises need to absorb quality resources from global brands through overseas merger and acquisition activities, and build core strengths on brand, technology and talent rather than low-end manufacturing, making technological upgrading faster and localizing global operations.

Gao Songya contributed to this story.