Younger generation drives online loan boom

Easy money can make life sweet, but borrowers may experience stress and suffering. Zhang Yi reports.

While their parents scrimp and save, putting every possible penny in the bank, the younger generation are more at ease with adopting luxurious lifestyles and spending as they wish, even with borrowed money.

In May last year, Xu Na hired a personal trainer for two months at a cost of about 5,000 yuan ($744), which was almost equivalent to her monthly salary as an office assistant in Fuzhou, Fujian province.

The cost didn't deter the 26-year-old, though. She borrowed the money through Jiebei, an online provider of small loans operated by Alibaba's Ant Financial Services Group. Under the terms of the loan, she was allowed to repay the debt in installments over six months.

More loans followed through Jiebei. In June, she borrowed 3,000 yuan to pay for an English course, and in August she obtained a further 5,000 yuan for plastic surgery to give her double-fold eyelids, which she considers more beautiful. In total, she owed 13,000 yuan.

According to a report by Zhaopin, an online recruitment platform in Beijing, about 22 percent of 16,000 white-collar workers it surveyed last year were in debt, while about 20 percent had savings ranging from 10,000 yuan to 30,000 yuan.

"In addition to their salary, which determines how much they can borrow, more young people are using credit services, which directly affects the amount they are able to save," the report said.

Overspending

"I never hesitate when I want to buy something I like, because I want to live in the present and treat myself well," said Xu, who has worked for four years but doesn't have much money left each month after paying her rent and buying daily necessities.

A report by Ant Financial, which is best-known as an online payment platform, underlines that tendency, noting that last year about 56 percent of people age 35 or younger had no savings.

For the 44 percent who have started saving, the average amount they can put away per month is just 1,389 yuan, according to the report, based on 280,000 responses.

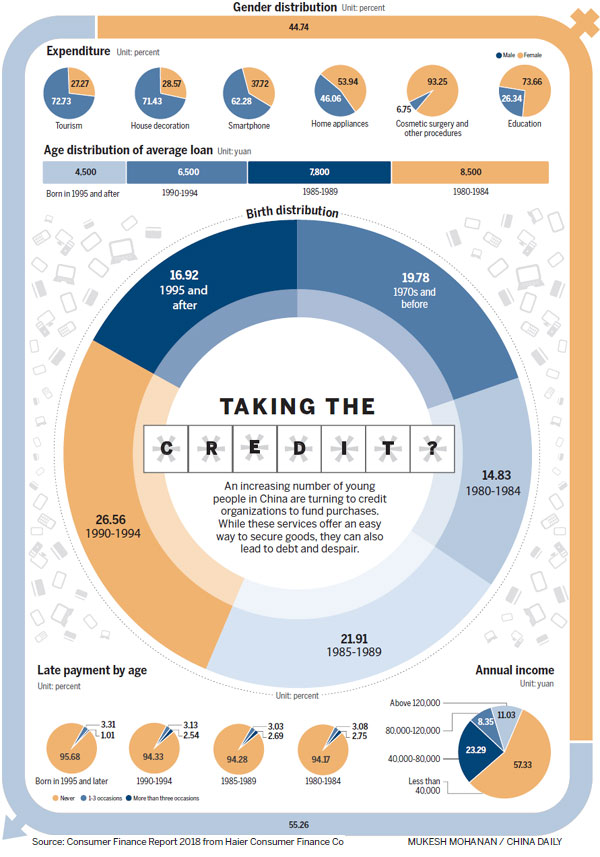

Moreover, a report released by Haier Consumer Finance Co, a provider of financial services, showed that those with an annual income of 80,000 yuan or less accounted for about 80 percent of the 4.5 million people in more than 300 cities who used credit services last year.

Those born in the 1990s accounted for about 43.5 percent of the total, while the proportion of those born in the 1980s was 36.7 percent, according to Haier.

After graduating in July, Deng Yu started work as a lawyer's assistant in Shanghai, earning 5,500 yuan a month. His basic living costs are between 3,000 and 3,500 yuan a month, including rent of 1,800 yuan for a bedroom of about 8 square meters and a small, shared living space, and buying three meals a day - often takeout fast-food.

"My living expenses can't get any lower. I live near my office in downtown Shanghai, so the rent is a little high, and I don't have time to cook because I usually work overtime and feel exhausted afterward," the 27-year-old said.

Deng usually spends the rest of his income on hanging out with friends at weekends or buying tickets for the theater. In January, he flew to Dubai for a weeklong vacation.

"I don't want to lower my standard of living, and spending is a good way to relax. However, because I don't have any savings, I sometimes worry about emergencies that could arise in the future," he said, adding that he believes his salary will rise.

Easy money

In recent years, many e-commerce companies such as Alibaba and JD have started offering consumer credit services, making it much easier for people to satisfy their desire to consume.

For example, people windowshopping on Taobao or JD can not only see the basic price of the goods, but also the options for payment by installments and the extra cost of doing so.

"This method tempts me to make a decision when I am hesitating about buying something out of my reach. When you visit e-commerce websites, it's easy to see promotions for shopping on credit," said Wang Guobo, a Beijing resident.

Wang made his first credit-based purchase in 2015, when he bought a set of headphones from Taobao for 2,700 yuan.

At the time, he was a graduate student with a monthly income of about 2,000 yuan from part-time jobs.

Wang got the headphones by borrowing money from the Ant Check Later service offered by Ant Financial, and repaid 250 yuan a month for 12 months, bringing the total cost to 3,000 yuan.

"It was convenient and easy to get the money, despite my low credit rating. The interest was a little high, but I didn't need to ask my parents for money or borrow from friends," he said.

"After all, it was just a couple of thousand yuan. If I had turned to my parents, maybe they would have complained that the headphones were too expensive. The monthly installments were easily affordable, and I could enjoy the headphones earlier (than if he had saved for them)."

A little later, he borrowed more money to buy a smartphone, again paying in monthly installments over a year.

The 30-year-old, who now earns about 10,000 yuan a month in Beijing, still uses credit frequently.

"If you plan carefully and are sensible about the amount you borrow, the 'buy now, pay later' experience is a good one," he said.

Problems

Despite the relative ease of borrowing, there is a downside. People who spend more than their salary to satisfy their hunger for consumption may experience stress-related problems and even leave themselves open to long-term debt.

Zou Jianjie, 25, does not have a stable salary. He usually earns a few thousand yuan a month as a salesman in Jinan, Shandong province, but he never balks at prices in the restaurants he takes his girlfriend to or the gifts he buys for her.

As a result of this unplanned spending and his unstable income, he often struggles to make it through to payday at the end of the month.

He occasionally borrows money from an older cousin to relieve his straitened finances. Sometimes he asks for just a few hundred yuan, but last month the figure was 2,000 yuan.

Xu Na said she learned her lesson from the debt she incurred last year.

"The money comes quickly, after just a few clicks on your phone," she said. "After you borrow the first time, you try again and may even become addicted."

The second half of last year was touch-and-go for her because she had to repay 2,000 to 2,500 yuan a month from June to January.

The monthly installments crippled her financially, given that she earns about 5,000 yuan a month and her rent accounts for 1,500 yuan of that sum.

"I reduced my other expenses to the lowest possible level. I didn't take taxis, have my hair styled or drink coffee. I even filled my stomach by eating the free cakes and fruit at my company's afternoon tea parties so I could skip dinner," she said.

In January, when Xu finally paid off all her debts, she felt an overwhelming sense of relief.

"I really got to know about pinching and scraping from that experience," she said. "I didn't tell my parents or ask friends for help; after all, it was my choice to borrow the money, so I had to deal with the fallout on my own."

Contact the writer at zhangyi1@chinadaily.com.cn

(China Daily 04/17/2019 page5)