State-owned carmakers join in charge onto ride-hailing scene

Nanjing-based T3 sets out in a bid to challenge Didi Chuxing's market dominance

Backed by a list of stellar investors, T3 - an emerging car-hailing app - was launched on July 22 in Nanjing, East China's Jiangsu province, where it's headquartered.

Involving three State-owned Chinese carmakers - FAW Group, Dongfeng Motor and Changan Automobile - as well as the country's largest internet companies - Alibaba and Tencent, T3 is set to become another challenger in China's ride-hailing market.

Of the 9.76 billion yuan ($1.42 billion) invested, 1.7 billion yuan was contributed by home appliance retailer Suning, making it the largest shareholder with 17.42 percent equity.

The three automakers FAW Group, Dongfeng Motor and Changan Automobile each took 16.39 percent equity as the second-largest shareholders.

Tencent, Alibaba and the rest of the affiliates invested a total amount of 2.25 billion yuan.

Cui Dayong, CEO of T3, said the company will debut in Nanjing followed by Chongqing and Tianjin as well as Wuhan in Hubei province, Guangzhou in Guangdong province and Hangzhou in Zhejiang province with 20,000 self-run online ride-hailing vehicles supplied by the end of this year.

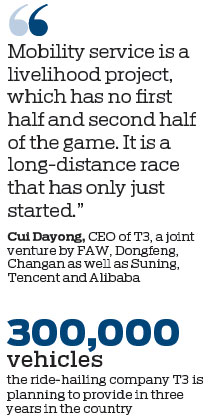

"We put 1,000 vehicles on the market on the day of T3's launch, and hope to add an average of 200 units per day in the future," said Cui. "A total of 300,000 online ride-hailing vehicles are expected to be released in the next three years."

As a newcomer in the country's ride-hailing market, T3 has an array of challengers, among which are the dominant car-hailing force in China - Didi Chuxing, as well as an offering from German auto giant BMW.

BMW launched its ReachNow ride-hailing service at the end of 2018 in China, becoming the first foreign automaker to join the race.

With a fleet of 200 BMW 5 Series, half of which are plug-in hybrids, BMW will complement its ReachNow car-sharing operation, run in partnership with local mobility company EVCard, using a fleet of 100 BMW i3s.

Data show that Didi's business covers more than 400 cities in China, with a market share surpassing 90 percent.

However, when it comes to earning performance, it's another story. Didi lost 10.9 billion yuan last year, and it spent 11.3 billion yuan on driver subsidies, according to Beijing Business Today.

Similar losses came to Shouqi Limousine& Chauffeur, started by State-owned Shouqi, which had a net loss of 58.72 million yuan in 2015, 881 million yuan in 2016 and 450 million yuan in the first four months in 2017, according to Beijing Business Today.

On Thursday, Didi Chuxing announced its partnership with Toyota Motor Corporation, with the latter investing a total of $600 million in Didi.

Together with GAC Toyota Motor Co, a joint venture is to be founded by the three parties to provide vehicle-related services for ride-hailing drivers on Didi's network.

Although it does not have the first mover advantage and the large market share of Didi, T3 aims to make space for itself.

"Mobility service is a livelihood project, which has no first half and second half of the game. It is a long-distance race that has only just started," Cui said.

Paying attention to the noteworthy problems existing in the online car-hailing market, including safety concerns, difficulty to hail a car and undisclosed charges, T3 is determined to run its online ride-hailing vehicles on its own, aiming to manage and supervise the service supply side effectively, according to Cui.

As the Chinese government enhances its supervision of online car-hailing services, new entrants will be more inclined to adopt the business-to-customer model, or B2C, according to Song Qinghui, an independent economist.

The existing car-hailing companies using a customer-to-customer approach, or C2C, may also increase the proportion of self-run vehicles, said Song.

Cui said T3 plans to consolidate its online car-hailing services between 2019 to 2021, expand its derivative business from 2021 to 2025, and forge itself into a leader in smart mobility and become a promoter in establishing smart cities from 2025.

zhangdandan@chinadaily.com.cn

|

Three of China's biggest carmakers Dongfeng, FAW and Changan have joined hands to establish a car-hailing company with investors including Suning and Alibaba. Provided to China Daily |

(China Daily 07/29/2019 page18)