Financial group now a leading channel of renminbi's global reach

Bank of China has spared no effort to push renminbi internationalization through a variety of channels in recent years.

The bank has become one of the leading channels in renminbi cross-border circulation.

It plays a crucial role in creating products and services in RMB internationalization, providing comprehensive services to clients at home and overseas, said the company's executives.

BOC is increasing its efforts to serve as a major channel for RMB cross-border clearing services.

|

Bank of China promotes renminbi internationalization through its professional expertise and global service network. Provided to China Daily |

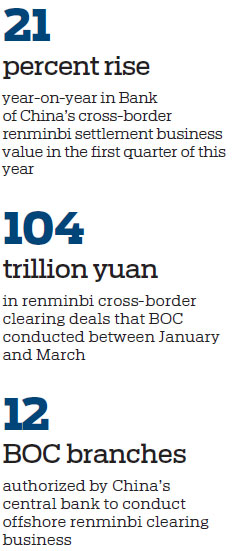

In the first quarter of this year, BOC's cross-border RMB settlements reached 1.62 trillion yuan ($241.25 billion), a 21 percent growth year-on-year.

Of all the RMB cross-border deals that took place on the Chinese mainland, one-quarter were settled through BOC.

BOC has also improved its RMB clearing service network around the globe.

In October 2018, the People's Bank of China, China's central bank, authorized BOC's Tokyo branch to be the RMB clearing bank in Japan.

BOC's Tokyo branch launched its renminbi clearing business on April 17, bringing the global financial center one step closer to become an offshore RMB trading hub.

The PBOC said that around 8 percent of the bilateral goods trade was settled in RMB in 2017 and China's cross-border RMB payment with Japan surpassed 450 billion yuan that year.

BOC branches in 12 countries and regions - Germany, France, Australia, Malaysia, Hungary, South Africa, Zambia, the United States and Japan, as well as China's Hong Kong, Macao and Taiwan - have been authorized as RMB clearing banks.

For the first quarter of this year, BOC has settled 104 trillion yuan in RMB cross-border clearing deals. It has consistently provided round-the-clock RMB clearing services for clients worldwide in an effort to promote RMB mobility.

Improving the connectivity between domestic and overseas capital markets has always been prioritized by BOC.

With China further opening its financial market, the cross-border use of RMB has become more frequent in recent years.

A growing number of overseas financial institutions are making their way into the Chinese market and the issuance of "panda bonds" is enjoying popularity.

BOC, with increased globalization as its advantage, has helped a number of countries including the Philippines and Hungary issue the panda bonds.

At the same time, BOC has worked to create different channels to help a variety of overseas institutes invest in China.

In 2018, BOC, together with the China Foreign Exchange Trade System and the National Interbank Funding Center, signed a strategic cooperation agreement with the Singapore Exchange to jointly promote the CFETS-BOC Traded Bond Index and its subindices outside China.

With the advantage of being a professional financial institute, BOC has published two indexes - the Cross-border RMB Index and the Offshore RMB Index - to help different market players observe the Chinese market.

It provides industrial players with a window to learn more about the progress in RMB internationalization, the company's executives said.

Since 2013, BOC has been carrying out an annual survey among its clients and publishing a white paper on RMB internationalization every year.

BOC's efforts in promoting RMB internationalization has won plaudits. In 2018, BOC was awarded "the best bank in RMB internationalization" by related authorities.

(China Daily 04/25/2019 page15)