On track to become major financial hub

Qingdao marks its first anniversary as a pilot area for China's comprehensive wealth management and financial reforms this year. City planners and financial players celebrated the milestone by looking at achievements so far and discussing hopes for the future.

"The rapid growth since last February, when the pilot area was approved by the central government, has signaled that a benevolent financial ecosystem with strong vitality is taking shape in Qingdao," said Liu Mingjun, deputy mayor of the coastal city in Shandong province. "We are pleased to see the city is on track to become a major financial center in Northeast Asia."

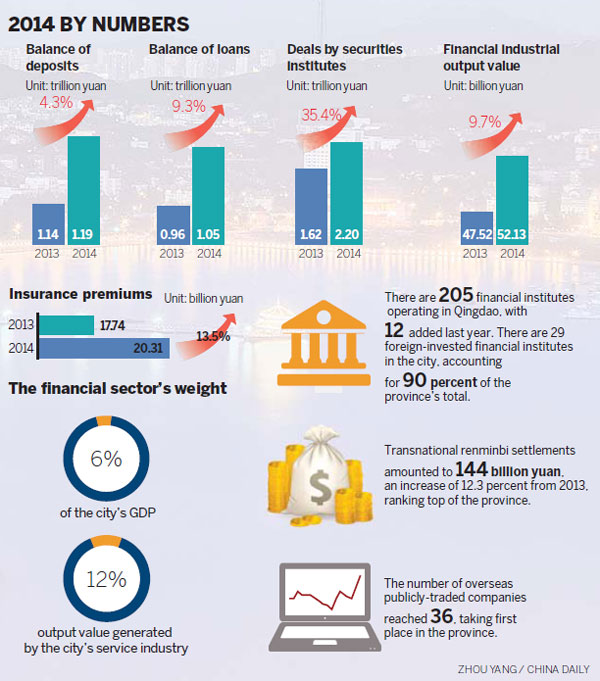

By the end of December 2014, total loans by local financial institutions reached 1.19 trillion yuan ($190.42 billion), an increase of 4.3 percent from a year earlier. Deposits in Qingdao's banks amounted to 1.05 trillion billion yuan, up 9.3 percent compared to 2013.

The total insurance premium in Qingdao reached 20.31 billion yuan and the overall turnover at the city's securities institutions surpassed the 2 trillion yuan benchmark.

There are now 19 financial corporations in Qingdao, four of which boosted their capital by a combined amount of 6.16 billion yuan last year.

A total of 205 financial institutions now operate in the city, 12 of which arrived last year. Micro-credit companies also mushroomed in Qingdao, with a combined registered capital of 6.65 billion yuan.

As an open economy, the city's financial sector has no lack of international elements, Liu said.

There are 29 foreign-invested financial institutions in the city, which account for 90 percent of the province's total. Last year, Cathay United Bank Qingdao Branch, the first Taiwan-funded bank in the city, opened. DBS from Singapore and ANZ Bank from Australia have started to prepare to open in Qingdao as well.

Trading in Korean won sped up in Qingdao, with a surge of over-counter cash transactions in won-yuan exchange. Qingdao Rural Commercial Bank was the first local bank to get the green light to finance business in Korean currency under a currency swap in China.

Zhao Minzhong, vice-president of HSBC China, said the bank's Qingdao operation grew to one branch and four sub-branches in the past 11 years.

"Our rapid growth can be largely attributed to the excellent financial environment in Qingdao, including modern infrastructure, ample talents and strong support from the government," he said.

Qingdao was one of a few pilot cities selected by the China Forex Bureau to enable multinational companies to manage one central account for their foreign capital within China instead of going through multiple overseas accounts.

Liu said the city's financial industry had started to play a dominant role in the local economy and in turn was propping up the real economy.

In 2014, Qingdao's small and micro enterprises received loans worth 17.93 billion yuan, an increase of 10.6 percent from the previous year. Loans for agricultural operations amounted to 24.39 billion yuan, up 10.7 percent.

The insurance sector insured the city's economic development with an accumulative amount of 6.1 trillion yuan by the end of 2014, a 24.3 percent increase from 2013.

Bai Guangzhao, director general of the Qingdao Municipal Financial Office, said the city developed a diversified capital market, which helps companies funnel funds through various financing solutions.

Qingdao is home to 40 large listed companies, including three that went public in Hong Kong last year. All the listed companies raised a total of 8.76 billion yuan from the capital market in 2014. At the same time, another 16 issued trading shares in China's "third board" or over-the-counter market.

Bonds sales grew 42.7 percent to 27.72 billion yuan in 2014, and private equity began to play an active role in the local capital market.

The city's emerging economic zones, including the Blue Silicon Valley, the West Coast New Area and the Hongdao Economic Area, were also boosted by the financial sector, with major infrastructure and high-tech startups receiving support, said Bai.

To ensure more people reap the benefits of the financial reforms, an inclusive financial system is being developed in Qingdao, with an additional 50 rural bank branches set up in 2014.

The city's financial network now covers all the rural areas of Qingdao, which helps farmers with their social security, medical care, agriculture and commerce financing and other services.

xiechuanjiao@chinadaily.com.cn

|

Qingdao, a pilot area for China's comprehensive wealth management and financial reforms, aims to become "a major financial center in Northeast Asia". Photos Provided to China Daily |

(China Daily 02/10/2015 page6)