Bank falls as govt takeover looms

Northern Rock Plc fell to an all-time low in London trading after Prime Minister Gordon Brown made his clearest indication yet that the bank may be nationalized.

Northern Rock fell as much as 24 percent and traded down 9.25 pence to 60 pence at 9:30 am in London. That followed Tuesday's decline of 16 percent and cut the mortgage lender's market value to 256 million pounds.

Brown said the United Kingdom is considering acquiring the mortgage- lender and reselling it when market conditions recover. The UK Treasury said it may nationalize the bank to recover more than 25 billion pounds in loans it made to Northern Rock and to protect depositors.

"Because stability is the issue, we will look at every option, and that includes taking the company into public ownership and then moving it later back into the private sector," Brown said in an interview with ITN's News at Ten program.

Northern Rock was bailed out by the Bank of England in September, when the collapse of the US subprime mortgage market drove up market credit costs, triggering the first run on a bank by depositors in the UK for more than a century.

The main opposition Conservatives said they may not back the nationalization of the Newcastle-based bank if the government proposed it.

"It would be very difficult for the Conservative Party to support an option such as nationalization," said George Osborne, the party's treasury spokesman.

The government would use a short emergency bill to nationalize Northern Rock, instead of buying the company in a conventional way, the BBC reported.

Waiting for funding

While private bidders, including billionaire Richard Branson's Virgin Group Ltd. and Luqman Arnold's Olivant Advisers Ltd. have set out plans to manage Northern Rock, they haven't secured funding to repay government loans made last September to stem a run on the bank.

Although "a number" of private companies had expressed an interest, the move may be necessary to protect the British economy, Brown said in the interview with ITN. "These are very difficult and turbulent times."

RAB Capital Plc and SRM Global Advisers, the hedge funds that became Northern Rock's biggest shareholders after the bank first ran into trouble, have urged the government to preserve the value of Northern Rock by avoiding a quick sale of its assets. They also have suggested legal action against the government.

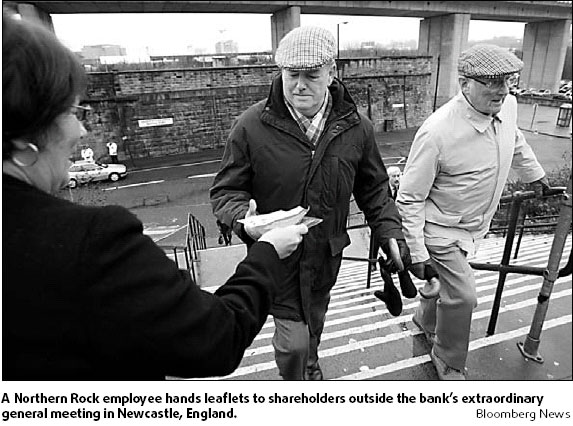

Northern Rock shareholders at an extraordinary general meeting on Tuesday voted in favor of a resolution proposed by Monaco-based SRM and London-based RAB Capital to prevent the bank from selling more than 5 million pounds of new stock without investor approval. They also re-elected directors.

Shareholders rejected proposals from the hedge funds to stop it from selling 5 percent or more of its assets without approval.

Northern Rock on Jan 11 agreed to sell mortgages valued at 2.2 billion pounds to JPMorgan Chase & Co to help repay loans from the central bank.

Goldman Sachs Group Inc has been hired by the Treasury to advise on how to make Northern Rock attractive to bidders. It was expected to report earlier this week.

Agencies

(China Daily 01/17/2008 page16)