Hurdles for red chips' homecoming

Homecoming is clearly the flavor of the season, as far as red-chip companies are concerned.

Homecoming is clearly the flavor of the season, as far as red-chip companies are concerned.

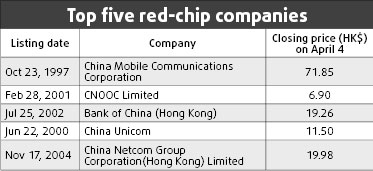

This year is set to see many of the Chinese conglomerates listed in Hong Kong head to the mainland market, following the trend set by the largest red chip, China Mobile.

CNOOC, China's top offshore oil company and the No 2 among red chips by market value, last month said it might float A shares this year if certain technical difficulties are sorted out.

Other large red chips such as COFCO International, the listed arm of COFCO China's flagship of grain, oil and foodstuff import and export and China Insurance International Holdings Co Ltd have also expressed their intention to list on the mainland.

The attraction of red chips and the mainland market is mutual. Excessive liquidity in the A-share market is piling pressure on the securities regulator to allow more companies to list in Shanghai and Shenzhen and the red chips are only too happy to grab the opportunity.

"The red chips and H-share companies should come to the mainland as soon as possible as the flood of new funds into the A-share market has created great demand for new shares," said Zhang Qi, an analyst with Haitong Securities.

But if a company wants to list directly on the mainland, it should be locally incorporated as Chinese laws do not allow overseas-incorporated companies to issue A shares.

"And it is impossible for Chinese regulators to change the law and permit all overseas-incorporated companies to issue A shares in the short term," Li Yongsen, professor with Renmin University of China, said.

According to Li: "The regulators are afraid that once the ban is lifted, many foreign companies will want to list on the mainland. The government certainly wants the red chips to come to the mainland market first."

The securities regulator prefers a direct listing model for red chips rather than the Chinese Depository Receipt (CDR) route, an investment tool that involves the sale of Hong Kong shares to A-share investors.

Shang Fulin, chairman of the China Securities Regulatory Commission (CSRC), last month said the regulator prefers red-chip companies to come to the mainland stock market by issuing A shares directly, rather than through CDRs.

"There are only certain particular technical obstacles for the direct listing model," Li of Renmin University said. "Only when all these problems are overcome can red chips start moving."

It will, however, take a while to iron out the technical obstacles in question.

For example, the par value of an A share and a red-chip share is different as all renminbi-denominated shares have an equal par value of 1 yuan. But red-chip shares are not renminbi-denominated, and have different par values. For some it may be HK$0.1, for others HK$0.5.

"Red chips should decide whether to change their existing par value in accordance with the current foreign exchange rate or to follow the mainland rule to issue A shares with the same par value," an industry insider said.

Besides par value, Zhou Dao, an analyst with Southwest Securities, said another obstacle is that the fiscal year is defined differently for red chips and A shares.

According to the mainland's accounting law, all companies should count their fiscal year from January 1 to December 31, while red chips are in line with the international norms and can choose their fiscal year freely.

"The regulators should clarify this point before red chips are listed on the mainland," Zhou said.

To iron out these differences, the regulator is drafting detailed rules to guide red chips listing on the mainland market, laying down the rules involved in each stage of the listing procedure such as securities depository, clearing, issuing and trading. The rules are expected to be compiled by the first half of this year.

The CSRC is also in talks with the Hong Kong securities regulator and the three bourses in Shanghai, Shenzhen and Hong Kong to find an efficient way for red chips to list on the mainland as soon as possible.

(China Daily 04/10/2007 page15)