Golden time for miners on demand, high prices

Gold output in China, the world's fourth-biggest producer of the precious metal, is set to maintain strong growth momentum this year, boosted by robust demand and bullish prices.

Gold output in China, the world's fourth-biggest producer of the precious metal, is set to maintain strong growth momentum this year, boosted by robust demand and bullish prices.

The National Development and Reform Commission (NDRC), China's top industry regulator, said on February 14 that the nation's 2007 gold production would reach 260 tons. This will represent an 8 percent increase from last year.

Zhang Yongtao, deputy secretary general of the China Gold Association, told China Daily gold production would climb by 5 to 6 percent this year from 2006.

"Domestic gold miners will further speed up production this year, inspired by strong demand and high prices," Zhang said.

He predicted China would be the world's No 3 or even No 2 gold producer in 2008, according to current growth.

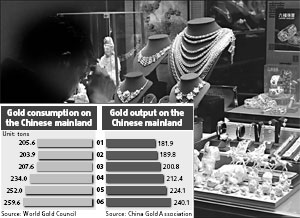

Last year, the country's gold production rose by 7.15 percent to 240.08 tons, behind South Africa, Australia and the United States, according to data from the Beijing-based gold association.

Cui Lin, an analyst with Antaike Information Development Co Ltd, the Beijing-based metal industry consultancy, said gold production in China is expected to increase by as much as 7 percent this year.

"Gold prices will continue to be on the bullish side and Chinese incomes will continue to grow steadily this year. Miners will produce more gold to satisfy mounting demand," Cui said.

NDRC said earlier this month that total gold production in the country would reach 1,300 tons from 2006 to 2010.

And it expected a total of 3,000 to 3,500 tons of gold mineral resources to be found in China.

Domestic gold miners have increased spending on prospecting and exploration considerably since 2001, when gold prices started to climb, according to Cui.

Statistics from the gold association showed the average price of aurum-99.99 gold in China rocketed by 32.35 percent, or 37.95 yuan per gram, last year from 2005.

Domestic gold prices began fluctuating in line with changes in the world's market in 2001 when the Shanghai Gold Exchange, China's sole national bourse for the metal, was formed in a move to open up the gold market.

The London Bullion Market Association recently predicted world gold prices would stay at $652.38 per ounce this year, up from less than $310 in 2006.

Consumer demand for gold in China will continue to grow this year following consecutive increases over the past four years, according to the World Gold Council, the London-based gold marketing organization funded by the world's leading gold miners.

The gold council earlier told China Daily that prospects for gold demand in China looked promising this year.

"Commemorative bars and coins for the forthcoming Year of the Pig have been selling rapidly since the last weeks of 2006 as the pig is the symbol of wealth and prosperity," the council said.

"Demand for both jewelry and investment products has reportedly been brisk in the first weeks of 2007 in the run-up to the Chinese New Year."

And the 2008 Beijing Olympics has spurred strong demand. "Olympic bars and coins also remain popular."

Last year, consumer demand for gold in China totalled 259.6 tons, up 3 percent from 2005, according to data from the gold council.

The figure maintains China's position as the world's No 3 gold consumer after India and the United States.

The 2006 demand consisted of 244.7 tons for jewelry, up 1 percent, and 14.9 tons in the form of net retail investment, an increase of 27 percent.

Trading volume at the Shanghai Gold Exchange, where there are 149 members conducting spot transactions with renminbi, jumped by 37.81 percent to 1,249.29 tons last year from 2005.

Albert Cheng, managing director of the World Gold Council Far East, suggested China should cancel its 17-percent value-added tax on physical gold trading to boost development of the gold market. The tax has been levied since 2005.

The gold council earlier predicted that consumer gold demand in China would reach 600 tons annually in coming years as a result of further opening of the domestic gold market.

Gold producers in China are benefiting from strong demand and bullish prices.

According to data from NDRC, the nation's gold mining sector reported 6.5 billion yuan in 2006 profits, surging 63 percent from the previous year.

(China Daily 02/28/2007 page15)